SFA On The Issues

Educating legislators and regulators on policy matters is essential to the structured finance industry.

CEO Michael Bright Discusses Advising Policymakers on SFA’s Issues in Fox5 Interview

Research Corner

SFA Research Corner: Trends in Consumer Credit Health Show Signs of Improvement

June 20, 2024

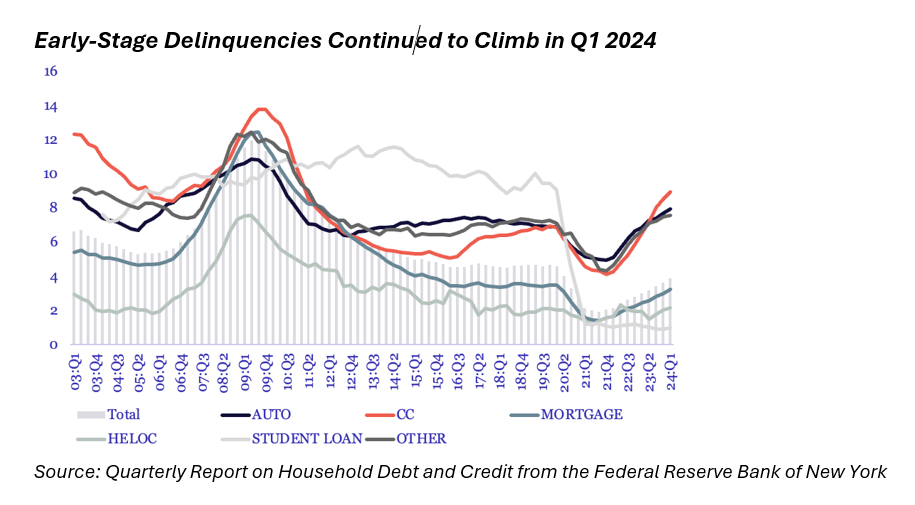

Consumer well-being is crucial for evaluating the risk and performance of $10 trillion of securitized products backed by consumer loans. Inflation has eroded purchasing power, leading to higher delinquencies and defaults, particularly among vulnerable borrowers.

What We’re Watching

Stress from Commercial Real Estate Will Persist

Regional banks are being disproportionately impacted by the deterioration in the CRE market and are increasing their credit loss provisions for these loans. Market downturns…

Key Threats Still Exist in the Financial System

The Financial Stability Board (FSB) is warning that an increase in shadow banking, or the movement of financial activity outside of the regulated banking system,…

Inflation, High Interest Rates Put Borrowers on Shaky Ground

American borrowers continue to grapple with rising prices and higher borrowing costs across all types of consumer debt. More Americans are carrying credit card balances…

Female Representation in Senior Leadership Is Stagnating. Here’s What HR Can Do About It

The global gender gap, a measure of gender inequality published annually by the World Economic Forum (WEF), narrowed slightly in 2024 to 68.5%, just 0.1 percentage-point higher…

More Women Are Working Than Ever. But They’re Doing Two Jobs.

More women than ever have entered the American workforce. Heavy demand for employees combined with more opportunities for remote work and a surge in female…

Join a Committee or Task Force

Add your voice, share your perspective, and develop solutions for the securitization industry.