Research Corner

Tracking market movements and macro signals that impact our members, and the performance of businesses and consumers that our market supports

Search research pieces

SFA Research Pieces

SFA Research Corner: Introducing the SFA KnowledgeHub

December 14, 2023

This edition of Research Corner introduces the beta release of the SFA KnowledgeHub, a flexible data platform created to acquaint non-members with pertinent information and provide members with swift access to vital industry data sources.

Amount Funded By

Our Market

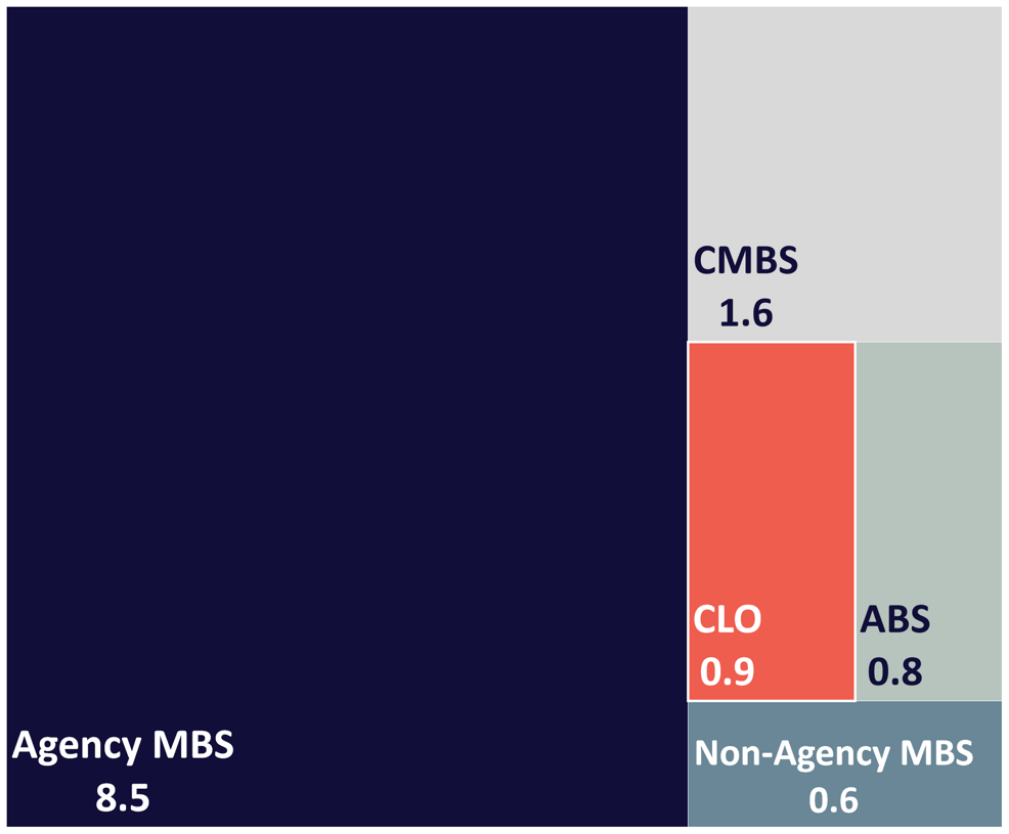

Total Securitizations Outstanding in Trillions (Year-End 2020)

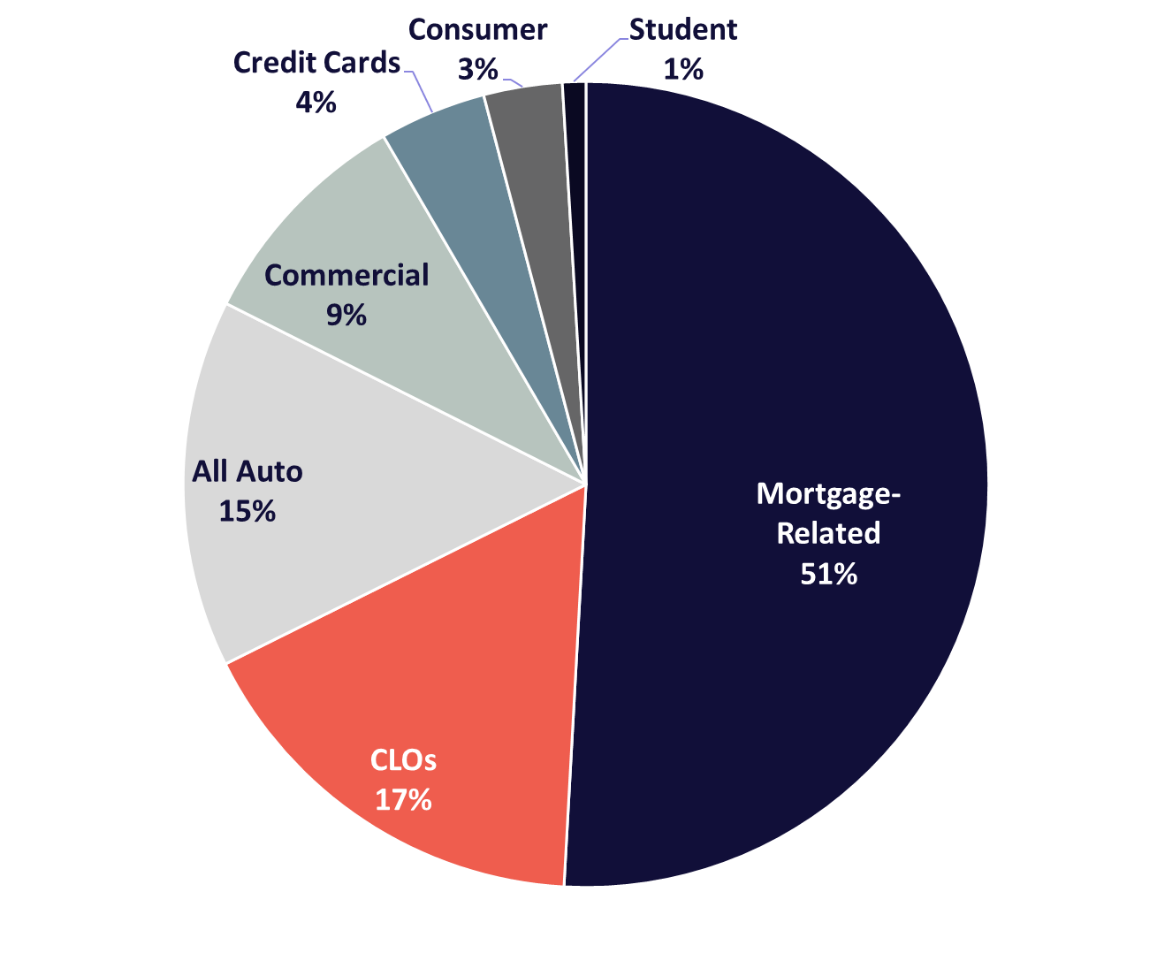

Total 2022 YTD Private Market Securitization $745 Billion

In The News

Stress from Commercial Real Estate Will Persist

Regional banks are being disproportionately impacted by the deterioration in the CRE market and are increasing their credit loss provisions for these loans. Market downturns…

Key Threats Still Exist in the Financial System

The Financial Stability Board (FSB) is warning that an increase in shadow banking, or the movement of financial activity outside of the regulated banking system,…

Inflation, High Interest Rates Put Borrowers on Shaky Ground

American borrowers continue to grapple with rising prices and higher borrowing costs across all types of consumer debt. More Americans are carrying credit card balances…

Female Representation in Senior Leadership Is Stagnating. Here’s What HR Can Do About It

The global gender gap, a measure of gender inequality published annually by the World Economic Forum (WEF), narrowed slightly in 2024 to 68.5%, just 0.1 percentage-point higher…

More Women Are Working Than Ever. But They’re Doing Two Jobs.

More women than ever have entered the American workforce. Heavy demand for employees combined with more opportunities for remote work and a surge in female…