SFA Research Corner Library

article by Structured Finance Association

A publication that follows trends in the primary and secondary securitization markets and a brief analysis of the macro indicators that impact our industry.

SFA Research Corner: Securitization On Track for a Strong 2024 – July 18, 2024

By mid-year, securitization market activity reached $939 billion, with private sector issuance at $413 billion, a 66% increase over 2023’s year-to-date level. Market experts anticipate a strong year-end, projecting private sector supply to surpass 2023 levels by 20-30%. Positive economic indicators, easing financial conditions and limited credit deterioration have bolstered market sentiment, lowering borrowing costs.

SFA Research Corner: Trends in Consumer Credit Health Show Signs of Improvement – June 20, 2024

SFA Research Corner: Trends in Consumer Credit Health Show Signs of Improvement – June 20, 2024

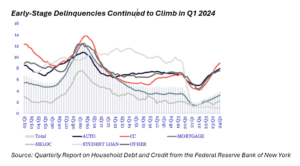

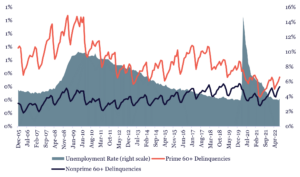

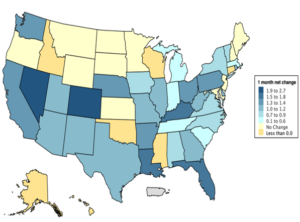

Consumer well-being is crucial for evaluating the risk and performance of $10 trillion of securitized products backed by consumer loans. Inflation has eroded purchasing power, leading to higher delinquencies and defaults, particularly among vulnerable borrowers. National data shows a significant rise in first-time delinquencies and personal bankruptcies in Q1 2024. However, a marked improvement in unsecured consumer loans suggests that the deterioration in consumer credit may be leveling off. Read More.

SFA Research Corner: Learning Curve: Unpacking Shifts in Student Loan ABS – May 30, 2024

SFA Research Corner: Learning Curve: Unpacking Shifts in Student Loan ABS – May 30, 2024

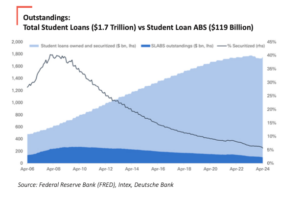

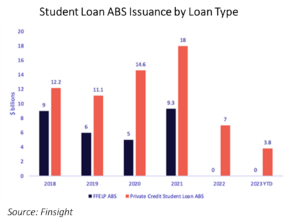

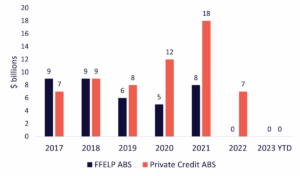

The United States has accumulated $1.7 trillion in student loan debt, with the government now directly holding 92% of these loans. Recent changes in interest rates and government policies have further influenced refinancing trends and delinquency rates, affecting borrower decisions in both federal and private loan sectors and impacting the supply of student loan ABS. Additionally, we offer a timeline of the legal proceedings between the CFPB and NCSLT, including the latest developments. Read More.

SFA Research Corner: Mind the Gap: Cessation of CDOR Presents an Opportunity for Canadian ABCP – May 16, 2024

On June 28, 2024, the Canadian Dollar Offered Rate (CDOR) will cease, ending the Bankers’ Acceptance lending model. This leaves a C$80 billion gap in money market options for Canadian investors. Canadian bank-sponsored Asset-Backed Commercial Paper, currently valued at C$48 billion, emerges as a potential substitute to address a portion of this gap. Implications and opportunities will be addressed at SFCanada 2024 in Toronto on May 22. We briefly review the market in SFA’s Research Corner. Read More.

SFA Research Corner: Call or Hold: Understanding RMBS Call Option Triggers – May 13, 2024

SFA Research Corner: Call or Hold: Understanding RMBS Call Option Triggers – May 13, 2024

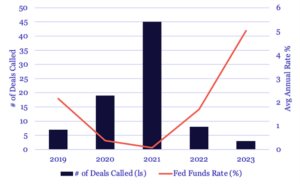

Residential Mortgage-Backed Securities (RMBS) deals often include call options, allowing issuers to terminate trusts early. However, with rising interest rates since 2022, financing new RMBS deals has become costlier, leaving many call options “deep out of the money.” Call options remain vital for managing RMBS trusts, providing flexibility amid market dynamics, including fluctuating interest rates. Read More.

SFA Research Feature: Harnessing the Potential in Private Asset-Based Finance – April 8, 2024

Private structured credit, known as Private Asset-Based Finance (Private ABF), is rapidly gaining traction as issuers seek diverse capital sources and banks adjust their lending practices. Launching a Private ABF strategy alongside an existing Traded Asset-Backed Securities (Traded ABS) team offers a pragmatic approach to adapt to this evolving landscape. By broadening the pool of capital providers, this strategy benefits issuers by expanding their funding options, investors by providing more diverse investment opportunities, and banks and service providers by increasing their market reach. Having a team well-versed in both strategies enables investors to navigate market changes effectively and capitalize on emerging opportunities. Read More.

SFA Research Corner: Home Equity Revival: Trends in Non-Agency RMBS – March 18, 2024

SFA Research Corner: Home Equity Revival: Trends in Non-Agency RMBS – March 18, 2024

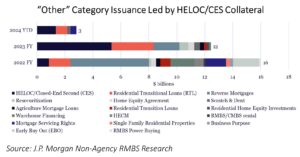

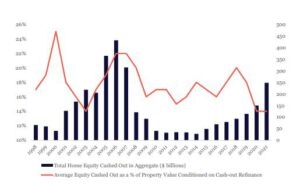

To date, Non-Agency RMBS supply stands at $18 billion, with non-QM-backed deals and jumbo mortgages leading issuance. Key drivers of issuance include non-QM-backed deals, jumbo mortgages, credit risk transfer securities, and “other”. In the “other” category, RMBS backed by HELOCs and CES loans emerge as leaders, boasting $1.4 billion in issuance. Today’s HELOC loans reflect stricter criteria post-2008, leading to lower delinquency rates. Concerns about the “using-the-home-as-an-ATM” mindset have diminished with higher interest rates. With growing demand for equity release products, market participants anticipate HELOC/CES-backed RMBS issuance in 2024 to match or exceed the $5 billion recorded in 2023. Read More.

SFA Research Feature: Surging Auto Insurance Premiums Impact Credit and Affordability – March 1, 2024

This week we are excited to introduce our Research Feature, part of a suite of research products that explore emerging trends in the broader economy and their potential impact on securitization. Our inaugural feature, titled “Surging Auto Insurance Premiums Impact Credit and Affordability,” delves into the rise in auto insurance premiums and the strain they place on household finances. For securitization participants, this trend demands attention as the upward trajectory of auto insurance premiums presents a significant challenge to the already declining credit performance of $1.5 trillion in auto loans. Authored by William Black of Black Analytics LLC, this feature draws on his extensive expertise gained during his tenure at a leading rating agency, where he led the Consumer Structured Finance New Issue Ratings team for the Americas for over two decades. Mr. Black authors a newsletter, Consumer Credit Matters, which can be found here. Read More.

SFA Research Corner: Sparked by Market Optimism Amidst FOMC Caution, January Sees Record-breaking Issuance – February 8, 2024

SFA Research Corner: Sparked by Market Optimism Amidst FOMC Caution, January Sees Record-breaking Issuance – February 8, 2024

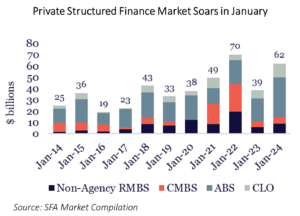

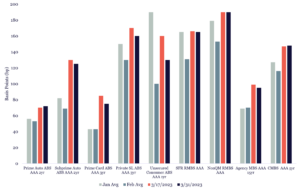

In January, the private structured finance market surged with issuance of non-agency RMBS, CMBS, ABS, and CLO reaching $62 billion, making it the second most active January in the last decade. Despite the Fed’s cautious stance on interest rate cuts, growing optimism for a soft landing and potential rate cuts in 2024 have spurred market activity, leading to increased issuance and tighter credit risk spreads. Read More.

SFA Research Corner: Credit Card and Auto ABS—Mostly Ready for Economic Challenges – January 25, 2024

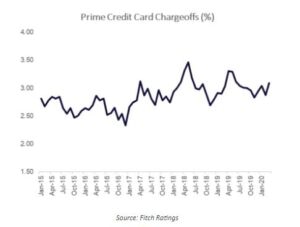

In the first three weeks of 2024, over $21 billion in new ABS deals were issued, with 82% ($18 billion) attributed to consumer-related transactions. Despite some ABS trusts showing weaker performance, investor interest in consumer ABS remains strong, supported by robust structures designed to withstand the expected softer economic conditions of 2024. A study from the Federal Reserve Bank of Philadelphia reveals that delinquency rates for credit cards issued by large banks now surpass pre-pandemic levels, nearing highs last seen in 2012. Read More.

SFA Research Corner: Structured Finance: A View on Market Technicals – January 22, 2024

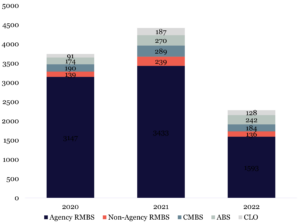

In 2023, issuers accessed the structured finance market, securing over $1.5 trillion in loans to support businesses, households, and communities. While overall issuance across the six major securitization sectors declined from 2022 levels, not all sectors witnessed a decrease in activity. The notable highlight was a 6% year-over-year increase in ABS supply, particularly, in ABS backed by prime retail auto loans and leases. The possibility of a soft-landing economy, slowing inflation and rate cuts later in the year have the potential to revive economic activity, which may enhance market liquidity and benefit securitization volumes, particularly in some sectors undergoing a downturn. Read More.

SFA Research Corner: Introducing the SFA KnowledgeHub – December 14, 2023

SFA Research Corner: Introducing the SFA KnowledgeHub – December 14, 2023

This edition of Research Corner introduces the beta release of the SFA KnowledgeHub, a flexible data platform created to acquaint non-members with pertinent information and provide members with swift access to vital industry data sources. The Hub, currently organized into three key areas—How Securitization Helps Your State, Explore Data from the Home Mortgage Disclosure Act (HMDA), and Market Trends We Track—offers interactive, customizable reports that can be emailed or downloaded in CSV format. With access to over 10,000 data sets, continuously expanding, users can seamlessly integrate disparate data sets from various sources. Designed to be adaptable and responsive, we will enhance the platform based on user feedback, adding data sets and creating alternate report templates to highlight industry-relevant metrics. Read More.

SFA Research Corner: Private Credit Loans Trending Larger, Contributing $22bn to CLO New Issuance in 2023 – November 30, 2023

SFA Research Corner: Private Credit Loans Trending Larger, Contributing $22bn to CLO New Issuance in 2023 – November 30, 2023

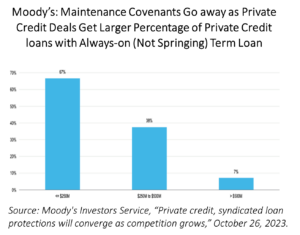

In a recent analysis of 28 private credit loans and 15 broadly syndicated loans, Moody’s identified a noticeable correlation between the expanding size of private credit loans and the diminishing presence of financial maintenance covenants. Unlike the covenant-lite structures commonly associated with syndicated loans made to large companies, private credit loans made to middle-market companies have historically been characterized by robust covenant packages and maintenance requirements. In 2023, CLOs backed by private credit loans have contributed $22 billion to the $99 billion CLO new issue market. This marks an 85% increase compared to the previous year and stands in stark contrast to CLOs backed by broadly syndicated loans, which experienced a 31% decline during the same period. Read More.

SFA Research Corner: Housing Market Seesaw and Securitizations—Sales Down, Equity Up – November 9, 2023

SFA Research Corner: Housing Market Seesaw and Securitizations—Sales Down, Equity Up – November 9, 2023

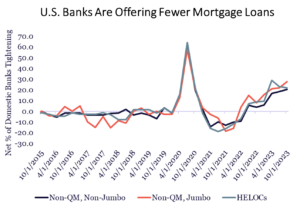

The October 2023 Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS) reports lending standards tightened for all categories of residential real estate loans and HELOCs amidst reduced demand, suggesting challenging times ahead. Tighter lending standards, a preponderance of low-interest rate mortgages, and non-financial pandemic related factors have disincentivized owners from selling or refinancing their homes, depressing origination volumes. With less than two months of the year remaining, non-agency RMBS issuance is on track to end the year 60% below 2022’s annual volume. Soaring home prices, on the other hand, increased home equity in the aggregate to $31 trillion according to the Federal Reserve, supporting interest in RMBX backed by home equity-related collateral. Read More.

SFA Research Corner: How Securitization Helps Connect Communities Through a “Series of Tubes” – October 26, 2023

SFA Research Corner: How Securitization Helps Connect Communities Through a “Series of Tubes” – October 26, 2023

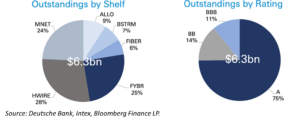

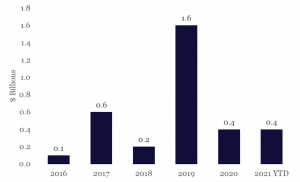

Fiber optic broadband infrastructure is poised for expansion, with growing consumer demand and government initiatives like the $42 billion Broadband Equity, Access, and Deployment (BEAD) program. Expansion, however, is capital-intensive. To fund this expansion, six broadband providers have turned to securitization as a more cost-effective funding option. On August 9, Frontier Communications issued $1.6 billion, backed by specific fiber assets and customer contracts, marking the largest Fiber ABS transaction to date. This issuance, upsized from $1 billion, contributes to the $6.3 billion currently outstanding in the Fiber ABS sector. Read More.

SFA Market Snapshot: October 19, 2023

We continue to track the health of the securitized markets and note three developments. While new issue supply is suppressed for most securitized asset classes, auto ABS and private credit CLOs show sizeable upticks compared to 2022. Also on our radar is the impact that October’s student loan repayment restart will have on borrower wallets and student loan ABS performance. Finally, Worker Adjustment and Retraining Notification (WARN) notices, which can precede changes in the unemployment rate, moved higher in October. Read More.

SFA Research Corner: Consumers Turn to Credit Unions—Credit Unions Turn to Securitization – October 12, 2023

SFA Research Corner: Consumers Turn to Credit Unions—Credit Unions Turn to Securitization – October 12, 2023

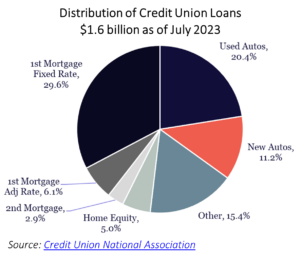

On September 26, Ent Credit Union, a federally insured state-chartered credit union (FISCU) in Colorado, issued its first auto loan ABS. This is the sixth credit union auto ABS this year, bringing the total to ten since credit unions entered the auto ABS market in 2019. Auto loans make up 31%, or roughly $500 billion, of the $1.6 trillion of consumer loans held by credit unions. Remarkable loan growth in recent years attests to consumer demand, but also puts pressure on funding sources, impacts the balance sheet and, in the current interest rate environment, poses potential liquidity challenges. Larger credit unions have responded by turning to securitization. Read More.

SFA Market Snapshot: September 21, 2023

SFA Market Snapshot: September 21, 2023

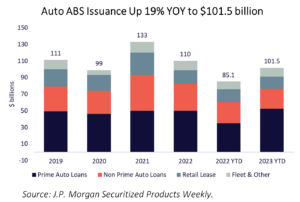

Though total ABS issuance shows a decline of 5% year over year, auto ABS is up 19% with nearly $102 billion of issuance to date due to stronger than expected 1H vehicle sales. With six deals currently in the queue, issuance activity is expected to remain robust in September. If the United Auto Workers (UAW) strike is prolonged, ABS issuance may feel an impact. Credit union securitizations are on the rise—with three deals totaling $793 million so far in 2023, following $760 million in 2022—and are expected to gain in popularity. Read More.

SFA Research Corner: Data Center Securitizations—Supporting the Rising Tide of Digital Flow – August 31, 2023

SFA Research Corner: Data Center Securitizations—Supporting the Rising Tide of Digital Flow – August 31, 2023

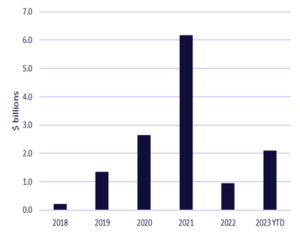

By collecting, storing, and processing data to support the platforms and services that support the digital world, data centers play a critical role in the day-to-day functioning of the internet. Remote work and learning, smart technologies, cloud services, and media and social media all added to the increase in global internet traffic—30% annual growth since 2018. Future demand is expected to drive this growth even higher. Data Centers have sought funding from CMBS and CRE CLOs since 2013 and from ABS since 2018, with $6.2 billion of ABS backed by data center revenue issued in 2021. Read More.

SFA Research Corner: Rate Reduction Bonds–Teaching an Old Dog New Tricks – August 17, 2023

SFA Research Corner: Rate Reduction Bonds–Teaching an Old Dog New Tricks – August 17, 2023

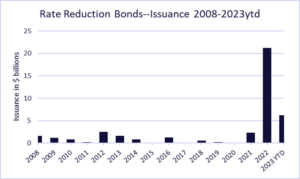

With 36 states having enacted renewable and clean energy goals, securing adequate financing is crucial in states’ efforts to transition effectively. Securitization, through the issuance of Rate Reduction Bonds (RRBs) is increasingly being used to fund these transition cost. RRBs were first used by utilities in the 1990s to reduce the impact of costs on consumer (ratepayers) associated with the deregulation of the electricity market. More recently, RRBs have been used extensively to ease the pain of wildfires in California (2017) and of severe winter storms in the south (2021). Now RRBs are being used to recover or reduce expenses associated with states’ transition towards sustainable energy sources and, specifically, to retire coal plants. In 2022, RRB issuance was 22 times greater than the average annual level of the past 14 years. Read More.

SFA Research Corner: Private Credit Fuels Middle-Market CLO Issuance – July 20, 2023

SFA Research Corner: Private Credit Fuels Middle-Market CLO Issuance – July 20, 2023

Issuance of middle-market CLOs (MM CLOs) has reached $12.1 billion so far in 2023, surpassing the supply recorded for all of 2022 and on track to reach a new high of $23 billion. The uptick has been facilitated by an increase in private credit, nonbank lending. A $1.3 trillion financial market, private credit exists outside traditional bank lending, the bank-intermediated broadly syndicated loan market and the public bond market. The collateral loans in an MM CLO are typically made to businesses that are “larger than small businesses but too small for large-scale commercial lending or syndicated credit,” according to the Federal Reserve, with annual revenues ranging between $10 million and $1 billion. There are over 200,000 middle market (MM) companies in the U.S. contributing 33% to the U.S. economy. Read More.

SFA Research Corner: Securitization Issuance Subdued in First Half of 2023 – July 13, 2023

New issuance of securitized products reached $744 billion in the first half of 2022. Private market securitization volumes are down 45% compared to the first half of 2022. The decline has been led primarily by non-agency RMBS and CMBS volumes which fell by 80% and 73%, respectively, as higher interest rates negatively impact lending activity. Two bright spots amidst the widespread decline has been auto ABS, which increased 18% year-over-year, and middle-market CLOs, where issuance more than doubled over the same period. Read More.

SFA Research Corner: Moving Towards Decarbonization—A Look at Freight ABS – June 29, 2023

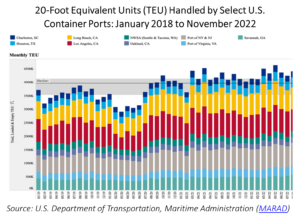

Shipping is the leading transportation mode for U.S.-international trade moving $1.1 trillion (43% of total trade value), two-thirds of which is containerized thanks to greater efficiencies and growing demand. New regulations from the International Maritime Organization (IMO) aimed at decarbonizing sea freight could reduce ships’ CO2 emissions by 37% in 2030 and 96% by 2040. If adopted and successfully implemented by member countries, the impact would be meaningful: shipping contributes 3% of the world’s greenhouse gas emissions – or put another way – “if shipping were a country, it would be the world’s sixth biggest greenhouse gas emitter. Container leasing companies have been relying on the securitization market for funding since the 1990s —there is approximately $13.5 billion of container ABS currently outstanding. To the extent that decarbonization proposals are executed, container ABS could join railcar ABS to facilitate the decarbonization transition. Read More.

SFA Research Corner: What to Expect When You’re Expecting: Student Loan Repayment, Consumer Credit and ABS – June 15, 2023

SFA Research Corner: What to Expect When You’re Expecting: Student Loan Repayment, Consumer Credit and ABS – June 15, 2023

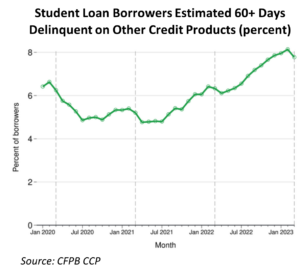

With a provision in the debt limit deal, 26.6 million student loan borrowers are expected to restart payments in August, adding an average of $203 to their monthly household debt obligation of $2600. Collection efforts, including wage garnishment, will resume for another 7 million loans. The impact to consumer credit will be negative. A 2022 study from Consumer Financial Protection Bureau (CFPB) identified 15 million borrowers that are considered at-risk for delinquency as soon as payments resume. This number could be higher as credit card and auto loans report higher delinquency rates. Income gains, particularly for younger borrowers, may ease some of the economic stress for these households. Read More.

SFA Market Snapshot: June 1, 2023

SFA Market Snapshot: June 1, 2023

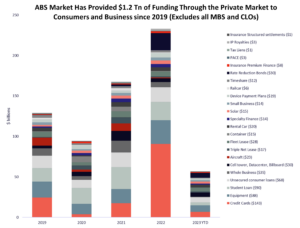

SFA’s Market Snapshot looks at the $115 million of funding that the ABS market has provided to consumers and businesses in 2023 and $1.2 trillion since 2019. The top asset classes of ABS supply are bonds backed by auto loans and leases (42%), credit cards (12%), student loans (7.7%), equipment loans and leases (7.5%), and unsecured consumer loans (5.8%). The remaining 25% is backed by a myriad of financing instruments — future cash flows of music royalties, PACE loans for green building renovations, loans to small businesses, and aircraft and container leases. These esoteric ABS, which tend to have higher yields, can be attractive to investors in a stable economy, but may experience a drop in demand during periods of economic uncertainty if investors become more risk-averse. Read More.

SFA Research Corner: Music Royalty ABS — Remastered for Streaming and Beyond – May 26, 2023

SFA Research Corner: Music Royalty ABS — Remastered for Streaming and Beyond – May 26, 2023

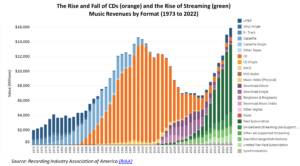

In 2022, three music royalty ABS transactions were issued for a total of $2.6 billion, according to Finsight, a significant increase over 2021 when one transaction for $304 million came to market. Music royalty ABS are backed by the rights to future income generated by publishing or recording royalties of music catalogs. Future securitization supply is supported by an increase in music sales, powered by the streaming-subscription model, and rising interest from proven artists to cash in their rights to future income streams. Risks unique to the industry notwithstanding, the alignment of inventory and investors could expand interest in this tuneful asset class. Read More.

SFA Research Corner: Leveraged Loans and CLOs – The (Credit) Squeeze is On – May 18, 2023

SFA Research Corner: Leveraged Loans and CLOs – The (Credit) Squeeze is On – May 18, 2023

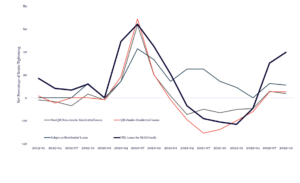

According to the April Senior Loan Officer Opinion Survey on Bank Lending Practices, more banks reported tighter lending standards on commercial and industrial loans in the first quarter of 2023 (46% versus 44.8% in 4Q 2022), increasing cost of loans (from 47.8% to 62.3% of respondents) and charging a premium on riskier loans (50% to 62.9%), levels not seen since 2009. Over the same period, demand for loans weakened further—55.6% reported weaker demand versus 38.8% the quarter before. In this Research Corner we look at the impact of tighter credit on leveraged loans and CLOs. Read More.

SFA Market Snapshot: May 4, 2023

SFA Market Snapshot: May 4, 2023

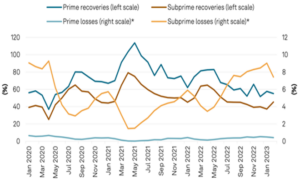

Amid continued muted issuance across the securitized space, credit risk spreads and trading volumes stabilized throughout April as the market incorporated banking turmoil news. Auto ABS performance is under scrutiny with delinquencies and losses in subprime auto loan ABS still elevated. Structural protections have helped this asset class weather credit challenges during times of economic distress. To the extent that credit conditions worsen, we would expect auto ABS structures to, by and large, continue to exhibit resiliency. Read more.

SFA Research Corner: Bringing Private Funding to the Decarbonization of Commercial Real Estate—C-PACE ABS – April 28, 2023

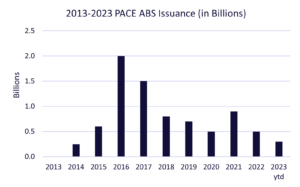

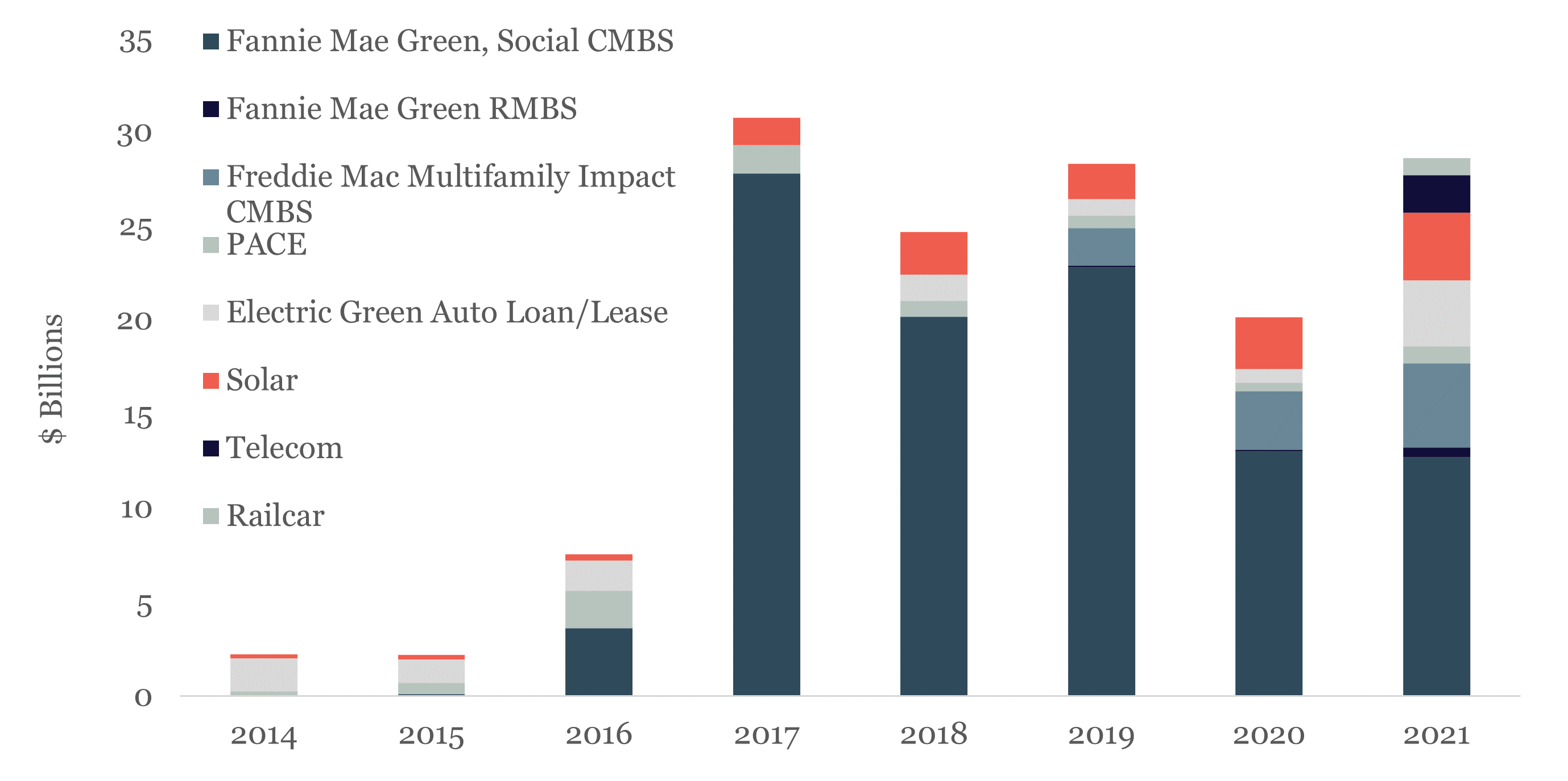

On March 31 Greenworks Lending issued C-PACE 2023-1, a $256 million transaction backed by Commercial Property-Assessed Clean Energy (C-PACE) loans that facilitate the financing of energy efficiency and renewable energy improvements on commercial properties. In the collateral pool are loans to hotel, multifamily, office, retail, industrial, and esoteric properties across 16 states. C-PACE originations have picked up in recent years according to a DBRS Morningstar commentary, with $1.3 billion and $1.51 billion being recorded in 2021 and 2022, respectively. As more states and municipalities enact net-zero rules for building stock, property owners will have to come into compliance with caps on GHGs and energy consumption, which could translate into higher supply of PACE ABS. According to Finsight, roughly $8 billion of ABS backed by PACE loans have been issued since 2014. Read more.

SFA Research Corner: To Extinguish Post-Pandemic Fires We Needed Water, We Got Gasoline – April 24, 2023

SFA Research Corner: To Extinguish Post-Pandemic Fires We Needed Water, We Got Gasoline – April 24, 2023

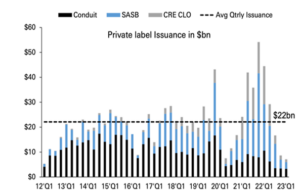

This issue of Research Corner focuses on the $5.6 trillion commercial real estate (CRE) market. Already wrestling with declining values and decreasing demand for retail and office properties, the sector now faces refinancing challenges —an estimated $2.5 trillion in loans will mature before 2027—while sources of funding have pulled back. Banks, the largest CRE lender by far, tightened lending standards in 2022 and may face liquidity issues in 2023. Other lenders have also pulled back. Issuance in the private-label CMBS market, which contributes 14% of CRE funding, has been anemic in Q1 2023, showing a 73% drop from Q1 2022 with just $22 billion of new issue private label and agency CMBS. At the root of the problem is the unfavorable financing conditions brought on by higher interest rates and wider spreads impacting access to credit for all property types. Depending on the severity of near-term economic headwinds, the coming waves of refinances in CRE will bring significant changes to the sector. Read more.

SFA Market Snapshot: April 6, 2023

SFA Market Snapshot: April 6, 2023

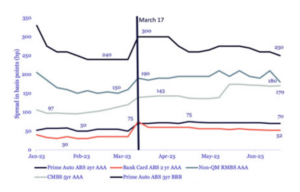

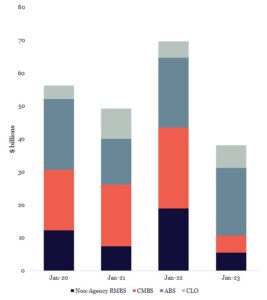

SFA’s Market Snapshot sees Q1 2023 issuance across non-agency RMBS, CMBS, ABS and CLOs fall 59% below its level year-over-year, where non-agency RMBS and CMBS sectors lagged by 79% and 81%, respectively. CLO supply continued to surprise to the upside, ending the quarter up 23% relative to Q1 2022. On March 17, credit risk spreads moved sharply wider, pushing prices lower, following SVB’s bankruptcy announcement. Despite subsequent news of banking failures, trading volume and risk spreads have modestly recovered as investor interest returned in highly rated, liquid ABS. CMBS/CRE credit spreads have continued to languish at wider levels, however, as tighter credit conditions at regional banks, which hold higher concentrations of CRE loans, continue to weigh on this asset class. Read more.

SFA Research Corner: U.S. Credit Card ABS Tacking Into Headwinds Stays the Course for Now – March 30, 2023

SFA Research Corner: U.S. Credit Card ABS Tacking Into Headwinds Stays the Course for Now – March 30, 2023

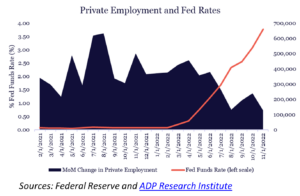

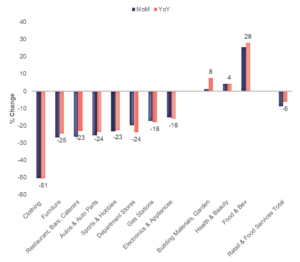

SFA’s Research Corner considers credit card ABS which, unlike other asset classes, are tied to the prime rate and are particularly sensitive to the Fed’s rate hikes. Credit card debt is nearing a record $1 trillion, up 15% year-over-year. Younger borrowers are mounting debt at nearly twice that rate and also pushing into delinquency at twice the rate for all age groups. Despite these trends, credit card ABS continue to perform well with pools that overwhelming reflect strong credit characteristics. Bank liquidity challenges notwithstanding, widening risk spreads on highly rated credit card ABS have recovered modestly as investors see strong performance and high quality loans as a safe harbor from intensifying credit headwinds. Read more.

SFA Research Corner: Sitting in Limbo Waiting for the Dice to Roll – An Update on Student Loan ABS – March 16, 2023

In SFA’s Research Corner, we see the waiting game playing out in student loans and student loan ABS (SL ABS). Performance for post-2010 private credit SL ABS and private credit refinancing SL ABS has been “solid” thus far, according to the S&P Student Loan ABS newsletter. The rating agency expects adequate levels of credit enhancement on investment-grade SL ABS to “absorb deterioration and remain stable.” High interest rates and the ongoing federal student loan repayment pause and interest waiver has dampened private student loan refinancing activity, negatively impacting new issue supply. Read more.

SFA Market Snapshot: 2023 Securitization Market Starts with Muted Supply and Still-Strong Investor Demand – February 23, 2023

SFA Market Snapshot: 2023 Securitization Market Starts with Muted Supply and Still-Strong Investor Demand – February 23, 2023

Private market volume fell 45% behind the issuance in January 2022 in RMBS, CMBS, ABS and CLOs, with the most pronounced lag in non-agency RMBS and CMBS. The lower supply and still-strong investor demand pushed bond prices up from December levels. Read more.

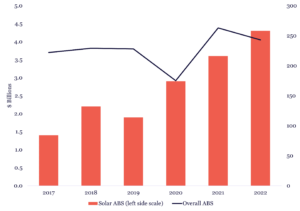

SFA Research Corner: Solar ABS Issuance Warmed by ITC and Alternative Energy Investing – February 2, 2023

SFA Research Corner: Solar ABS Issuance Warmed by ITC and Alternative Energy Investing – February 2, 2023

In SFA’s Research Corner, issuance of Solar ABS reflects the growing consumer interest in financing PV systems. In 2022, $4.3 billion of solar ABS were offered—a 207% increase over 2017 and a 20% increase over 2021—in a time when the broader ABS market dropped by 8%. According to the latest report from the Energy Information Administration (EIA), the demand for solar is expected to continue. Owing much to tax incentives like the federal Investment Tax Credit (ITC), the EIA anticipates renewable sources to provide 16% of electricity generation nationwide in 2023, 18% in 2024. Solar ABS, with its stable credit performance—90% of solar ABS bonds are rated investment grade according to KBRA’s Solar Loan Index—will continue to draw investors seeking highly-rated green investments. Read more.

SFA Research Corner: High Rates Slow MBS’s Run; 2023 Brings Its Own Challenges – January 19, 2023

SFA Research Corner: High Rates Slow MBS’s Run; 2023 Brings Its Own Challenges – January 19, 2023

SFA’s Research Corner looks at the impact that slower originations, higher borrowing costs and stressed market liquidity has had on MBS. Agency and non-agency RMBS and CMBS ended 2022 at $2 trillion, half of 2021’s volume. While performance is currently benign (as shown by FNMA/FHLMC residential loan pools) or improving (FNMA/GNMA commercial loan pools), banks are preparing for a challenging 2023. The Fed’s latest Senior Loan Officer Opinion Survey reports that a “significant” net share of domestic banks have tightened standards for multifamily loans and a “moderate” or “modest” net share of banks have tightened standards for residential loans. Read more.

SFA Market Snapshot: January 12, 2023

SFA Market Snapshot: January 12, 2023

January’s SFA Market Snapshot closes out 2022’s decline in issuance. Total issuance was down 48% for the year as MBS sectors (agency RMBS, non-agency RMBS and CMBS) pulled back meaningfully. ABS supply has been relatively steady compared to other asset classes, down 10% for the year. Higher borrowing costs dampened appetite for new financings as pricing for new issues moved appreciably higher across asset classes.

SFA Market Snapshot: December 2, 2022

SFA Market Snapshot: December 2, 2022

New issuance across non-agency RMBS, CMBS, ABS and CLO is down 30% year-over-year. Compared to the broader market and other asset classes, ABS supply has been relatively steady, down 13% for the year. Market participants expect ABS supply in 2023 may further decline, particularly in subprime sectors, as rising interest rates further suppress borrower demand and credit concerns impact investor demand. In his recent speech, Fed Chairman Jerome Powell attempted to manage expectations about the length of time it might be “necessary to hold policy at a restrictive level.” Chair Powell said that several closely watched macroeconomic data points including the labor market—jobs available/workers available currently at a 1:1.7 ratio)—would have to moderate further before the Fed would be prepared to be less restrictive.

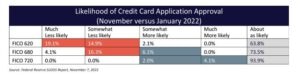

SFA Research Corner: Banks Pull Back on Credit Card Loans for Some Borrowers as Demand Grows

SFA Research Corner: Banks Pull Back on Credit Card Loans for Some Borrowers as Demand Grows

November 17, 2022

The FED’s November 7 release of the Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS) showed that demand for credit card loans has become stronger even as banks tighten access to credit for borrowers with lower credit scores. While market volatility and inflationary concerns have pushed credit spreads wider, investor demand for credit card ABS has held steady due, in part, to the asset class’s strong performance. So far in 2022, issuance surpassing $27 billion (compared to $18 billion in 2021) is driven by maturing bonds and new receivables stemming from continued robust loan demand, factors that we expect will continue to drive issuance in coming years.

SFA Market Snapshot: November 3, 2022

This month in Market Snapshot, we saw secondary market risk spreads continue to drift wider, and prices lower, in response to increased volatility in the global bond and equity markets. Some view this as an opportunity to buy. In fact, the money managers, banks and hedge funds who responded to the Morgan Stanley’s 4Q22 Investor Survey said that they currently prefer high quality, short and medium duration securitized products over Treasury and Corporate Credit.

SFA Research Corner: Auto ABS: Ready to Handle Rough Credit Terrain Ahead –

SFA Research Corner: Auto ABS: Ready to Handle Rough Credit Terrain Ahead –

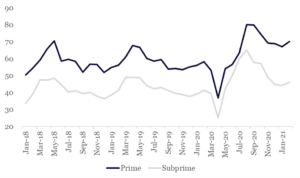

October 27, 2022

SFA’s Research Corner looks at auto ABS, which in 2022 has exceeded $90 billion in new issuance, $38 billion backed by prime auto loans and $27 billion funding subprime borrowers. But economic conditions are creating challenges, the biggest of which is the Fed’s inflation-fighting rate hikes which are expected to push unemployment to 4.4% by 2023—a significant increase compared to today’s 3.5%. Additionally, the possibility of continuing price increases for consumer goods could lead to more missed payments. However, the credit fundamentals of auto ABS remain firm for various reasons—the underlying value of the assets, consumer behavior and asset recovery rates—and the asset class is well-positioned for the anticipated shift in consumer credit quality.

SFA Research Corner: Tracking Cash-out Refi & Market Trends –

September 29, 2022

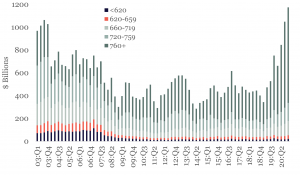

SFA’s Research Corner reviews non-agency RMBS and the recent trends in cash-out refinancings, a loan product that was prevalent in the run up to the 2008 housing crisis. While levels of cash-out refi’s have risen in RMBS pools—29% in 2022 of non-agency deals according to KBRA data—the characteristics of the underlying loans are very different—70% of recent borrowers have credit scores above 760 and the overall cash extracted is less than 60% of the amount cashed out in 2006, according to the Fed.

SFA Research Corner: Driving Towards Decarbonization: Connecting Auto ABS to Climate Change –January 19, 2022

Green auto ABS deals represented $3.5 billion of the $29 billion issuer-designated ESG securitizations in 2021. Proceeds from these deals financed the purchase of green vehicles at Tesla and Toyota, the inaugural issuers of green auto ABS deals, by financing low- or zero-GHG-emissions vehicles. At year-end, the EPA finalized federal GHG emissions standards for passenger cars and light trucks that are the “strongest vehicle emissions standards ever established for the light-duty vehicle sector,” that will result in avoiding more than 3 billion tons of GHG emissions through 2050. Rating agencies have been including GHG components in their credit analysis of auto ABS pools including the impact that the shift to decarbonized vehicles will have on vehicle valuations and thus on the credit performance of auto ABS.

SFA Research Corner: Stronger Assets, Lower Household Debt and Improving Labor Market: The Trifecta of ABS Credit Performance–December 16, 2021

SFA Research Corner: Stronger Assets, Lower Household Debt and Improving Labor Market: The Trifecta of ABS Credit Performance–December 16, 2021

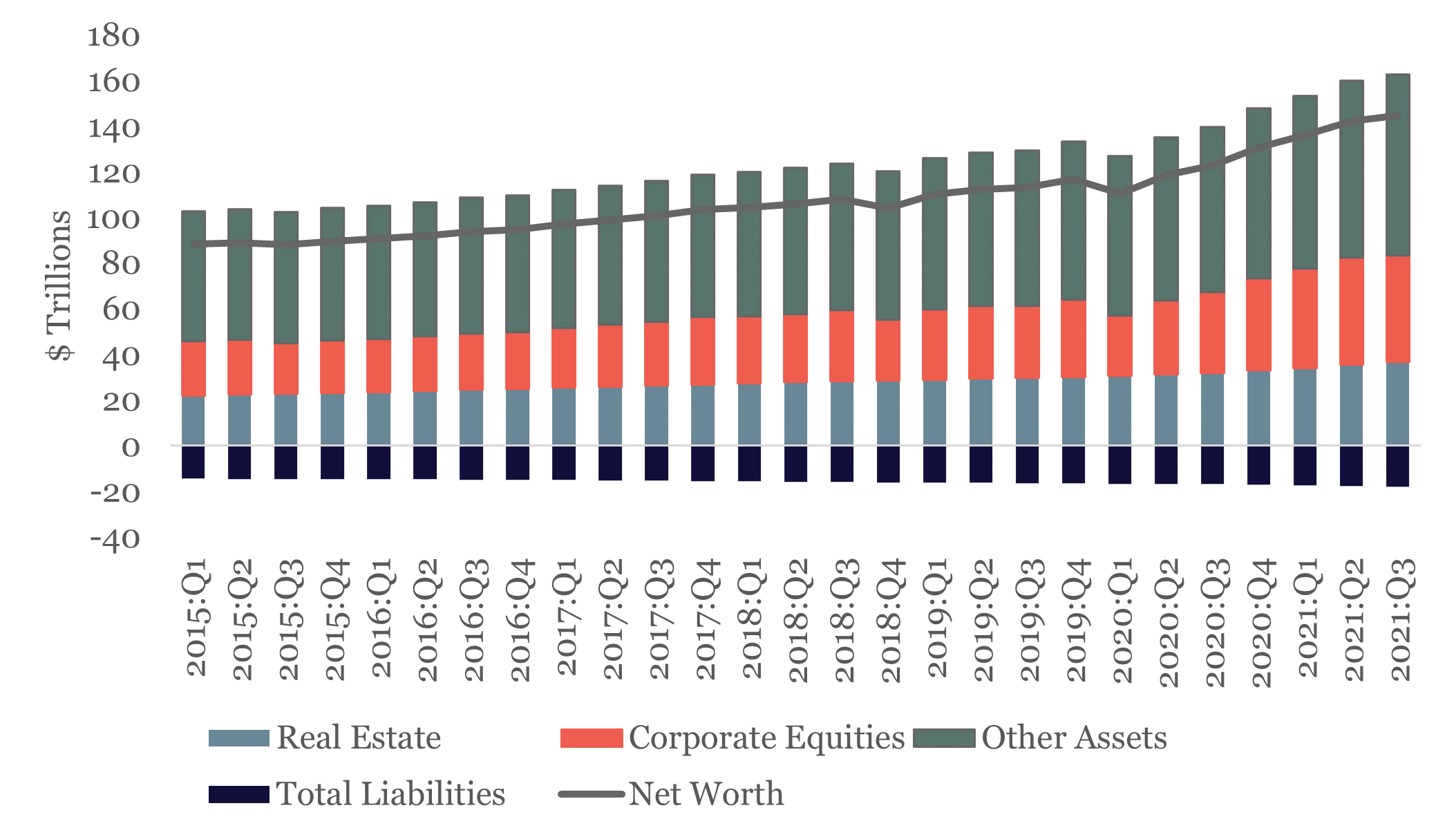

The Federal Reserve’s Z.1 data report, released on December 9, showed household net worth rose to $145 trillion and now stands 54% above its level five years ago. This rise in net worth is supported by real estate values, up 50%, and corporate equities like mutual funds, retirement or pension plans, up 90% over the same period. However, not all have benefited equally from the rise in asset values with the top 1% benefitting the most from the rise in corporate equity values. Stronger assets, lower household debt and an improving labor market have helped many households meet their financial obligations, which bodes well for the credit performance of securitization backed by consumers loans.

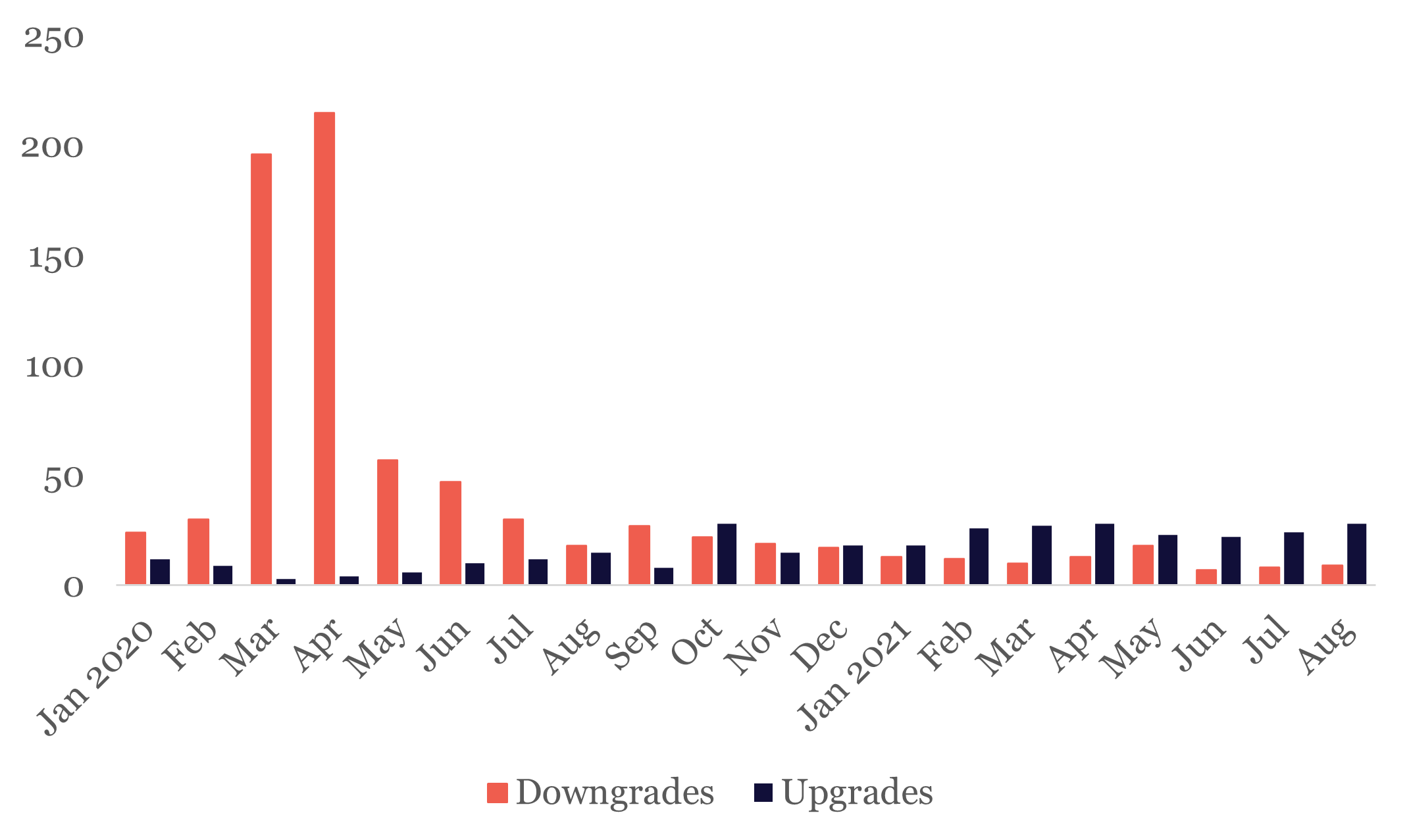

SFA Research Corner:A Good Year in Securitization Ratings; ESG-S Factors Continue to Impact-0December 09, 2021

SFA Research Corner:A Good Year in Securitization Ratings; ESG-S Factors Continue to Impact-0December 09, 2021

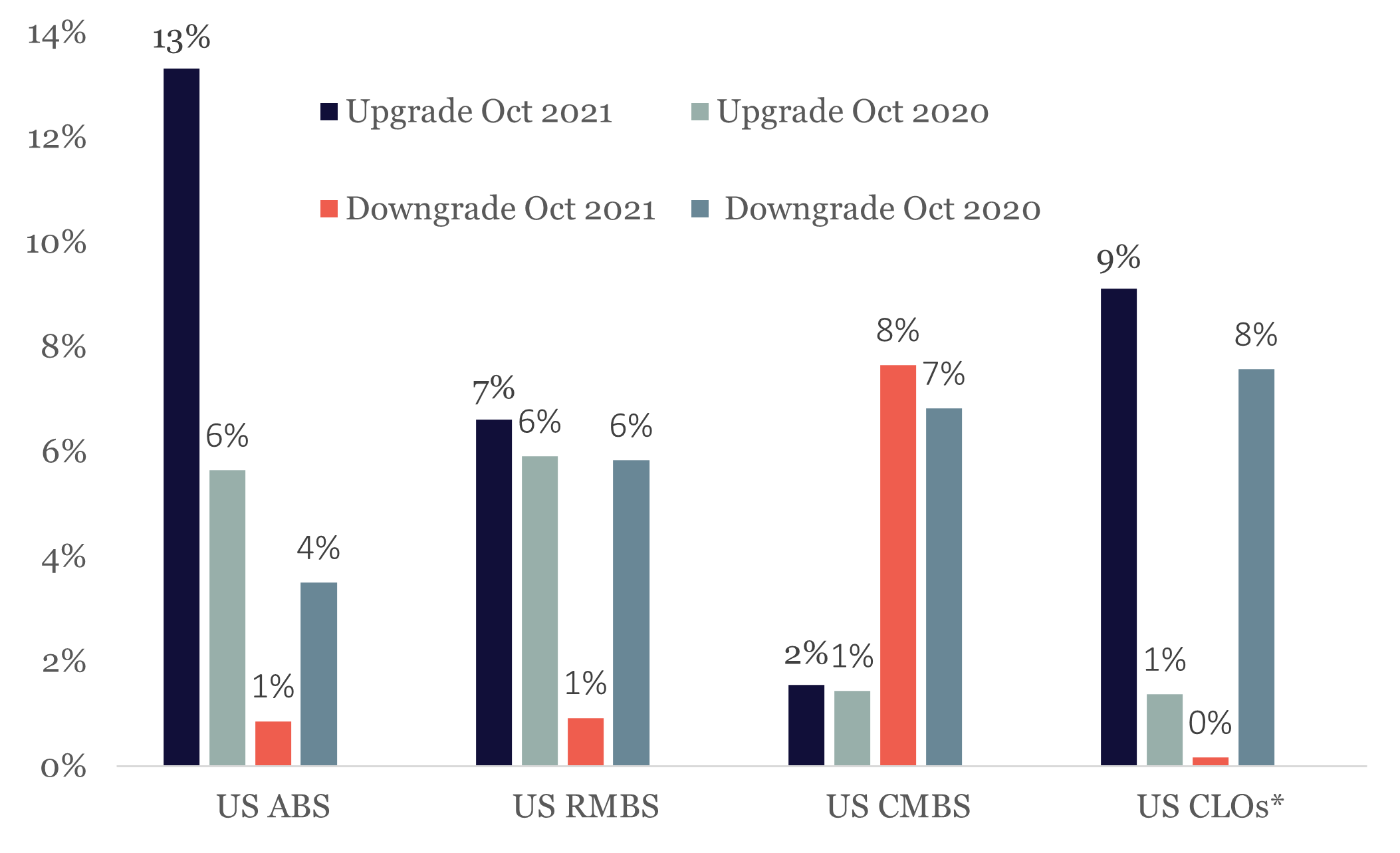

Credit ratings activity has been overwhelmingly positive for the U.S. securitization market as upgrades have easily exceeded downgrades, in 2021, according to Moody’s Investors Service. Auto ABS was by far the best performer as an average of 81% of the tranches in this sector have been upgraded. Credit rating actions related to ESG factors continued in 2021, albeit at a slower pace than in 2020 when they represented roughly 25% of the structured finance rating actions that year. S&P Global reported taking 137 negative ESG-related credit rating actions in 2021.

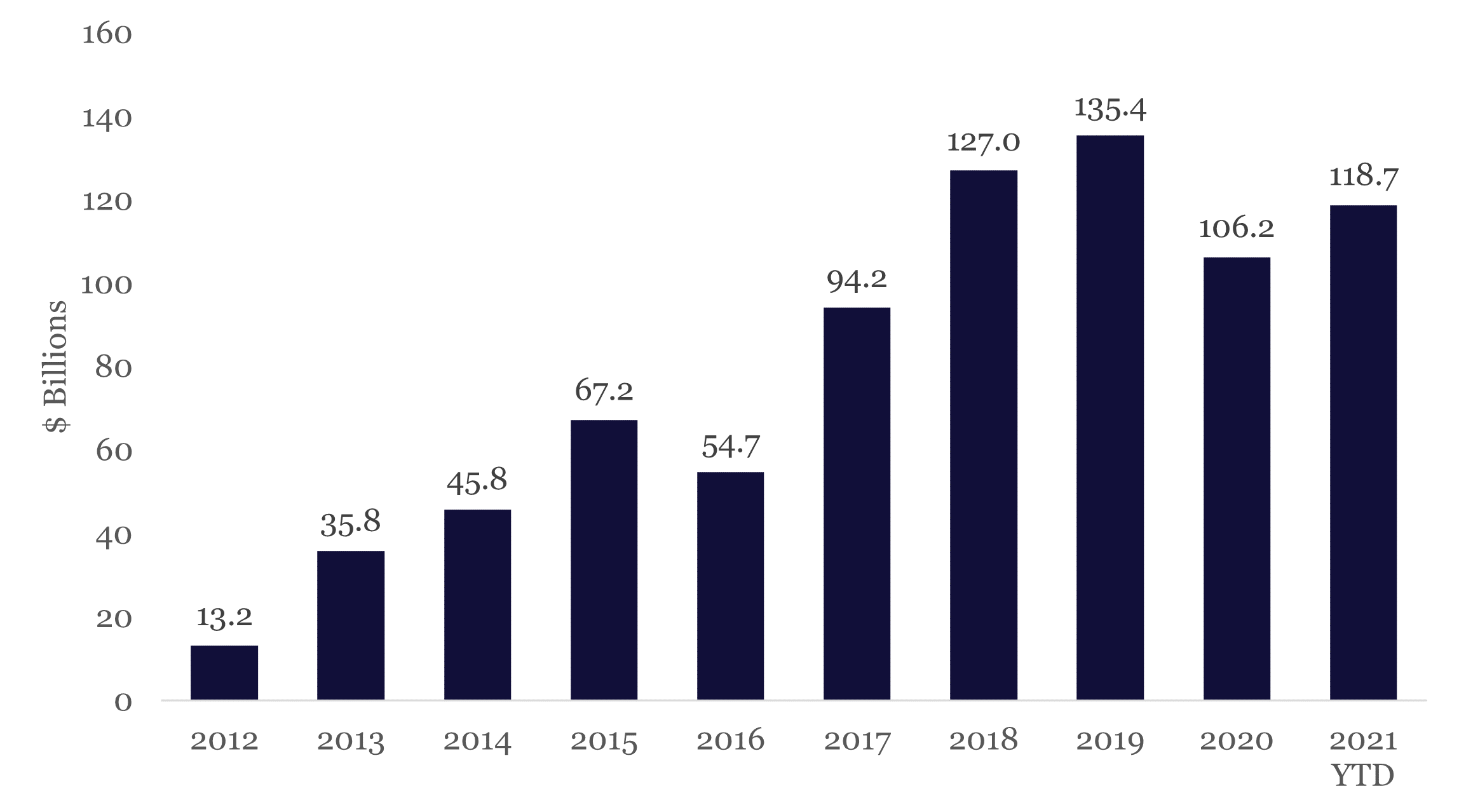

SFA Research Corner: Now You Cap It, Now You Don’t—FHFA Actions Added to Record Year for Non-agency RMBS – December 02, 2021

SFA Research Corner: Now You Cap It, Now You Don’t—FHFA Actions Added to Record Year for Non-agency RMBS – December 02, 2021

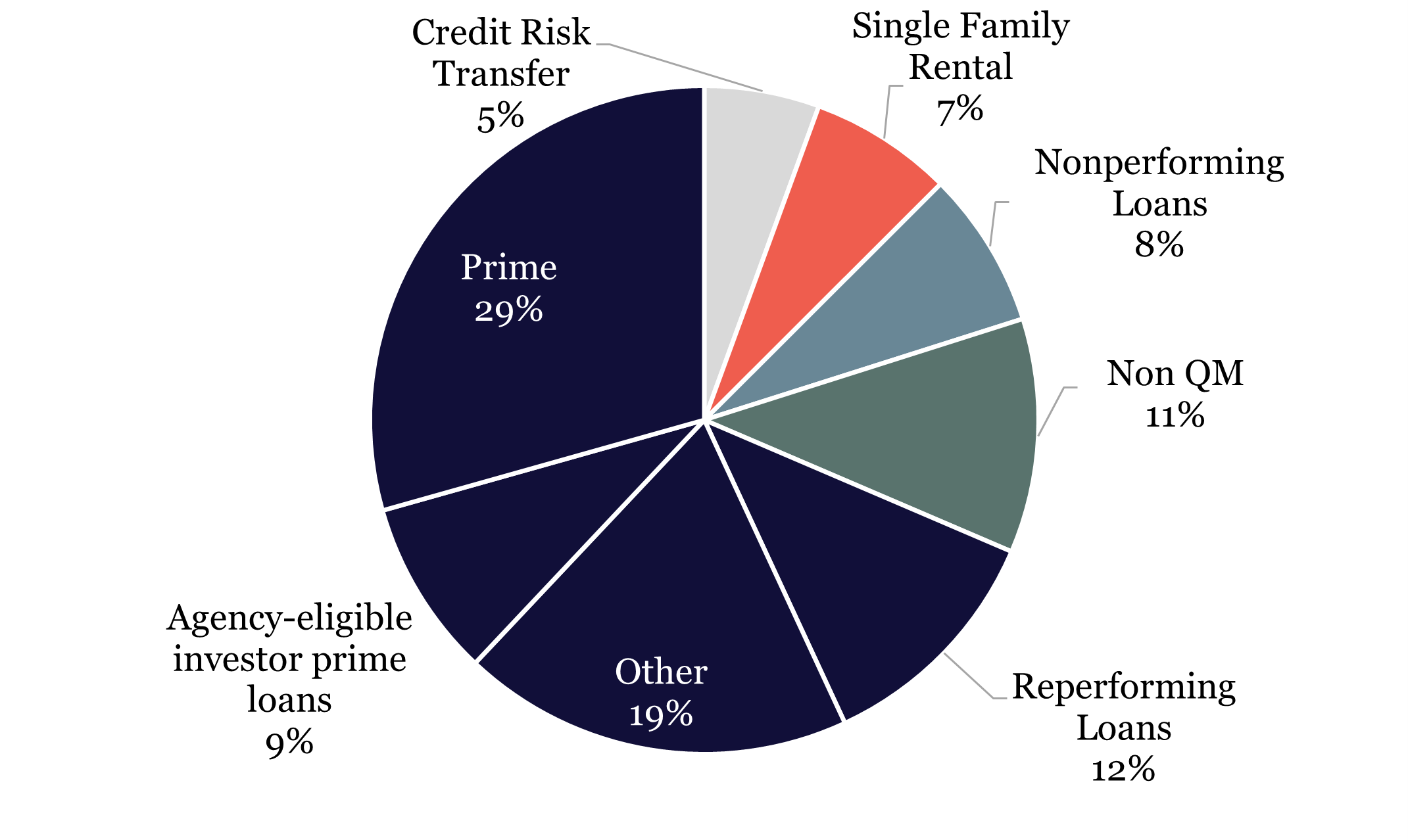

Non-agency RMBS is on track to surpass $200 billion, a record for the sector. Of that total, $17 billion, or 9% of the non-agency RMBS market is backed by agency-eligible investor mortgages, according to Deutsche Bank Securitization Research. Issuers turned to the private market to fund this loan type after the FHFA announced a 7% cap on Fannie Mae’s and Freddie Mac’s purchases of mortgages on second homes and investment properties. The suspension of the cap is under review by the FHFA. While suspended, new issuance might move away from the private label market and along with the recent 18% increase in loan limits, could further muddy the waters for the PLS market as it tries to commit to build infrastructure to support the housing market.

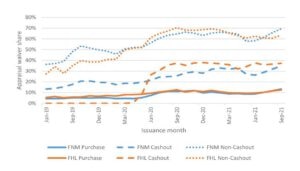

SFA Research Corner: Assessing Appraisal Waivers and AVMs – November 18, 2021

SFA Research Corner: Assessing Appraisal Waivers and AVMs – November 18, 2021

On October 18th FHFA Acting Director Sandra L. Thompson announced that the temporary use of desktop appraisals, adopted during the Covid-19 crisis, would become an established option. The FHFA is also considering the risks and benefits of the increased use of appraisal waivers, up more than 6.9 times the average level in 2018, as it continues to modernize the appraisal process. Additionally, the FHFA requested industry input on the risks posed by increased use of waivers and automated valuation models (AVMs) and comments on how expanded AVM use could impact racial bias in property valuations. Modernization of the appraisal process is included in the 2022 FHFA Scorecard, which holds the Enterprises “accountable for fulfilling their core mission requirements by promoting sustainable and equitable access to affordable housing and operating in a safe and sound manner.” Read more.

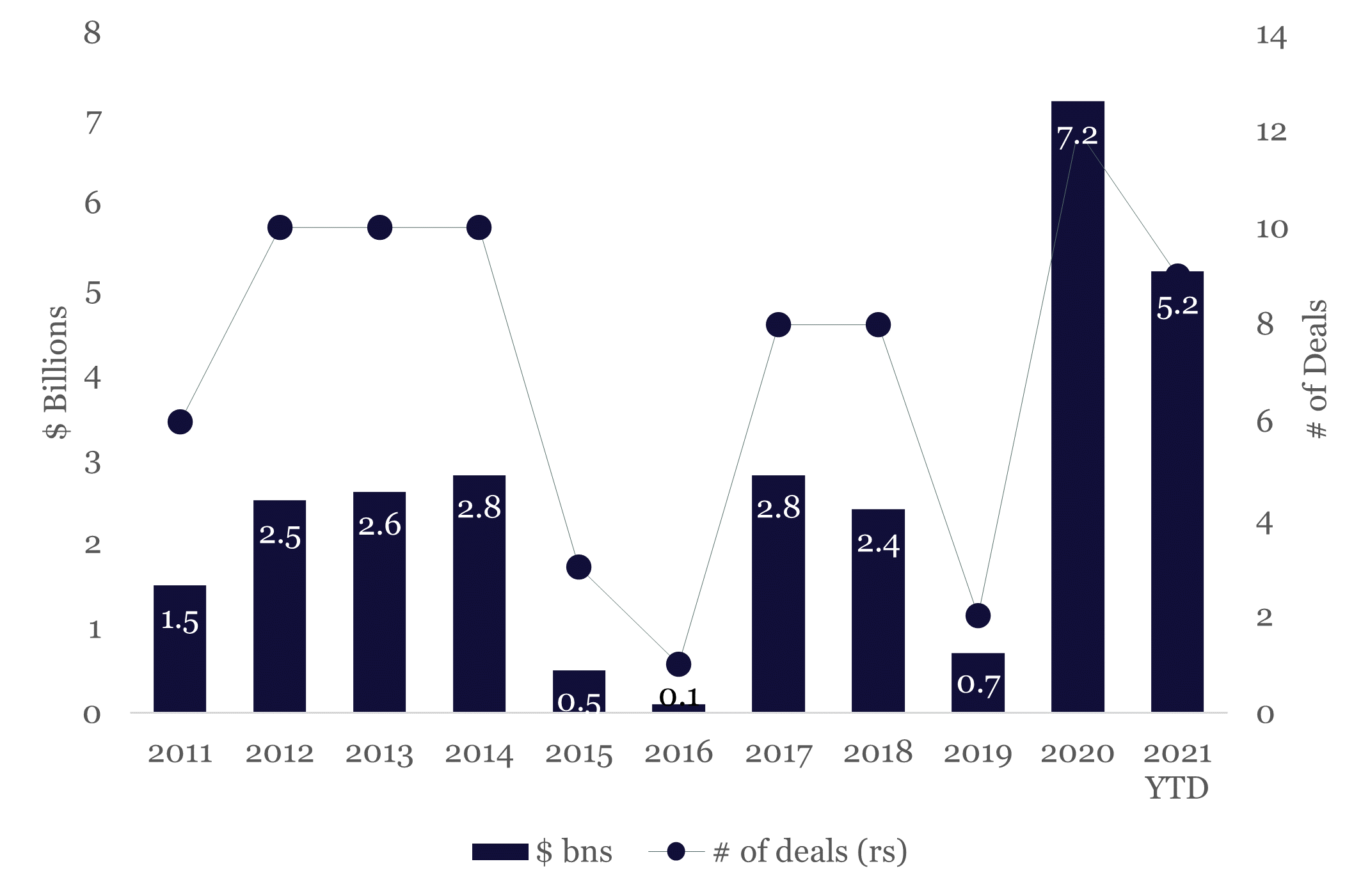

SFA Research Corner: Container Lease ABS – A Port in the Global Shipping Storm – October 27, 2021

As the broader shipping industry continues to be buffeted by supply chain complexities, container lease ABS have been buoyed by the rebound in global trade as demand for shipping containers has kept lease rates at all-time highs. In 2020, the ABS market saw 12 container lease ABS transactions totaling $7.2 billion, a record for the sector. And with $5.2 billion issued so far this year, 2021 is on track for another robust year. Even taking into account ESG issues like de-carbonization commitments and requirements to retool refrigerated containers with non-HFCs, freight transport (90% of which travels on ships in containers) has the healthy expectation to more than double by 2050, which bodes well for container ABS going forward. Read more.

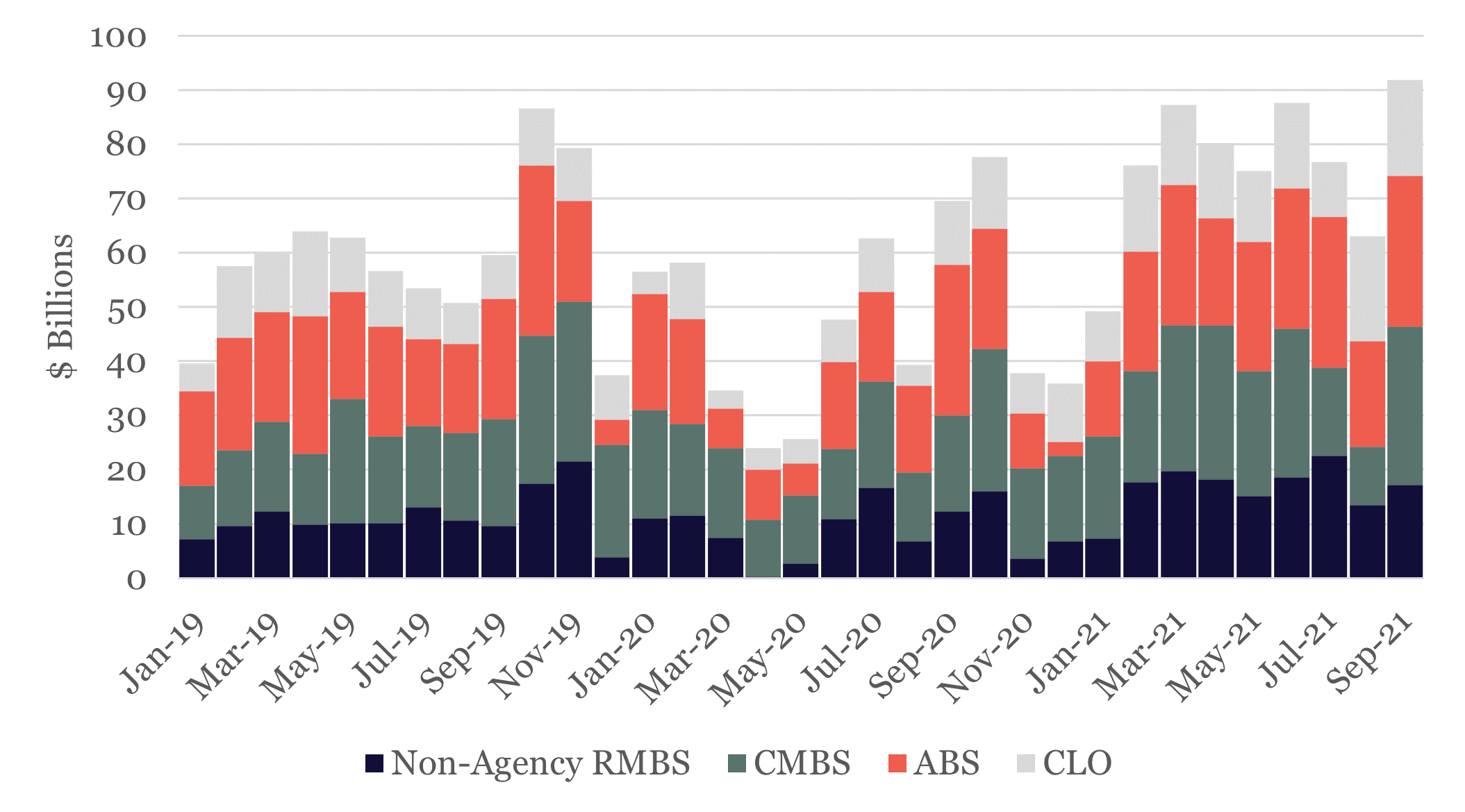

SFA Research Corner:A Deluge of Deals in September Sets New Highwater Mark – October 21, 2021

New-issue activity in September reached $92 billion, the strongest month of issuance for non-agency RMBS, CMBS, ABS and CLOs, to date in 2021. Another $23 billion issued in the first two weeks of October helped volume reach $710 billion, surpassing in under 10 months the level reached for the entire year of 2019. Driving this activity has been strong investor demand, and an understandable desire by issuers to avoid taper noise and to mitigate the effects of a LIBOR transition deadline. Despite the torrent of new supply, demand has kept bond prices firm. Read more.

SFA Research Corner: CLO Update—From Uncertainty to Thriving, But Mind the Zombies – September 22, 2021

CLO upgrades have outnumbered downgrades since the beginning of the year and thanks to an abundance of liquidity, the CLO exposure to defaulted leveraged loan collateral is now below pre-pandemic levels. Strong fundamentals and a search for yield has encouraged investor appetite for CLOs, easily absorbing this year’s new issue supply, which is on track to best 2019’s record year. As the leveraged loan pipeline continues to build, we anticipate a vigorous new CLO market for the near-term. One caveat to the rosy CLO outlook going forward is the potentially negative impact that newly created zombie firms will have on CLOs with exposure to them. Read more.

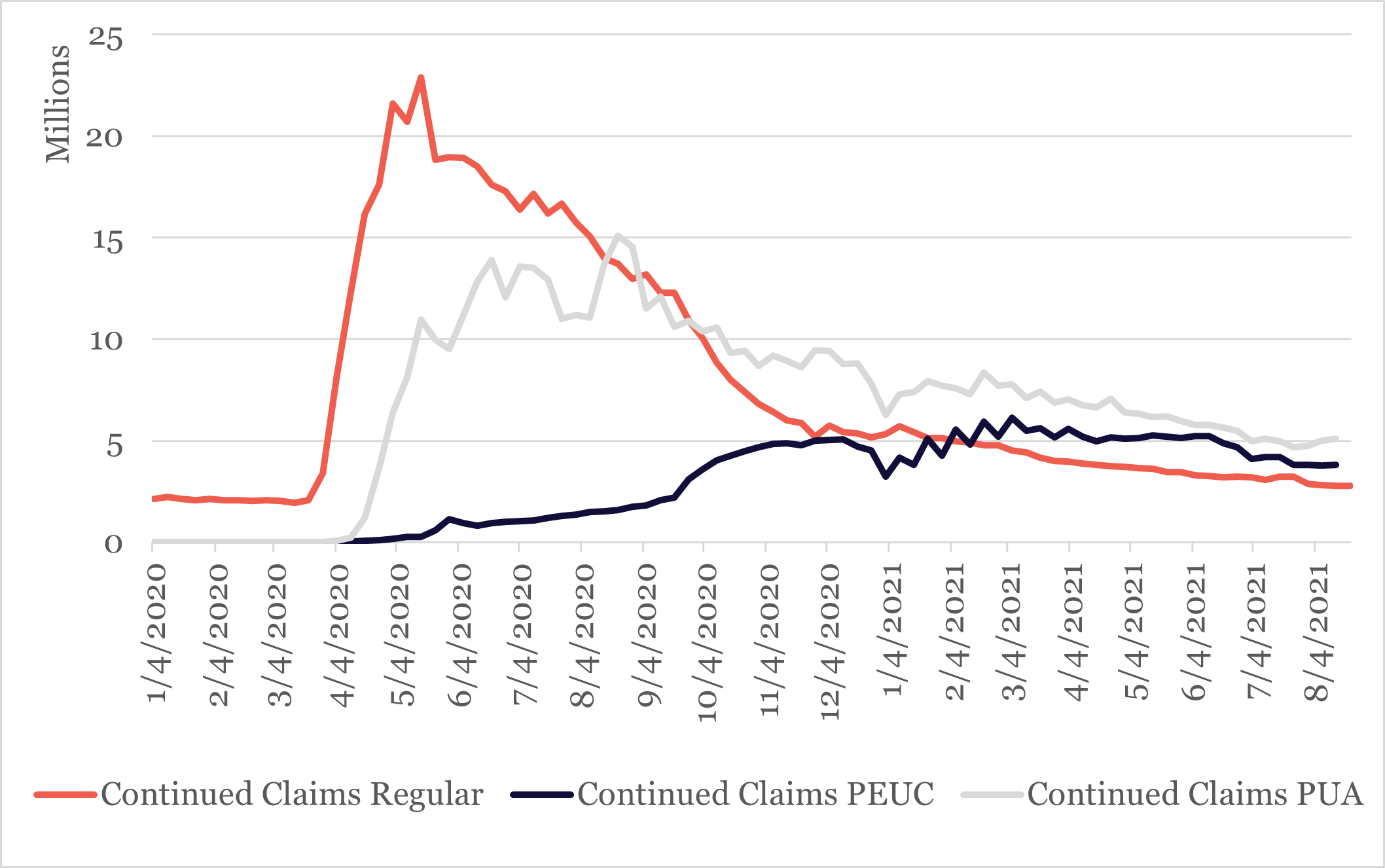

SFA Research Corner: End of Unemployment Benefits Could Lead to Short-Term Up-Tick in Delinquencies and Credit Card Debt – September 15, 2021

Close to 9 million Americans still impacted by pandemic-related unemployment saw the end of benefits on Labor Day. Federal Reserve research suggests that this support, while it was available, was used to pay down debt and stay current on bills. Without this support, we may see a rise in delinquencies, potentially impacting ABS performance, as hurdles to employment remain. Consumers may resort to credit cards for short-term liquidity. Read more.

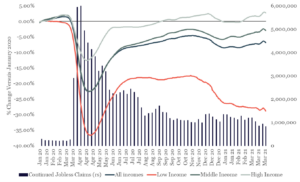

SFA Research Corner: Household Balance Sheets and Labor Markets Robust Even as Relief Programs Roll Off – September 7, 2021

SFA Research Corner: Household Balance Sheets and Labor Markets Robust Even as Relief Programs Roll Off – September 7, 2021

On August 26, the Supreme Court upheld a ruling to vacate the CDC’s eviction moratorium. This pandemic assistance program, which has primarily benefited lower-income households, has helped households stay current on their debt obligations despite elevated levels of unemployment. As the labor market and household balance sheets strengthen, usage of these programs has declined. Unemployment, expected to be re-established as the leading indicator of credit performance, will be the metric to watch as households begin to recover their economic footing. Read more.

SFA Research Corner: Strength in Non-QM and SFR Supports Surge in Non-Agency RMBS – August 12, 2021

Non-agency RMBS issuance is on track for a new post-2008 record. Year-to-date, new issue has reached $119 billion, surpassing 2020’s full-year volume and just 12% below 2019’s record year. Issuance for RMBS backed by non-QM and SFR loans are particularly robust and are expected to surpass previously set records. In this week’s research, we take a closer look at these two RMBS sub-sectors. Read more.

SFA Research Corner: Hertz’s New Lease on ABS – July 19, 2021

SFA Research Corner: Hertz’s New Lease on ABS – July 19, 2021

Hertz raised $4 billion through two ABS offerings from its new term ABS shelf, Hertz Vehicle Financing III. As a testament to the strength of the securitization market, investors’ search for yield in a prolonged low interest rate environment, and growing confidence in the recovery of the travel sector, Hertz raised this capital even as the company emerged from a highly visible Chapter 11 bankruptcy filing, a period of tumultuous leadership changes, and a global pandemic that shuttered the travel and tourism industry. Read more.

SFA Research Corner: The Road Back: What a Difference a Jab Makes – June 23, 2021

SFA Research Corner: The Road Back: What a Difference a Jab Makes – June 23, 2021

With more than 50% of Americans vaccinated, consumers are increasingly comfortable in resuming travel and leisure activities. This sector, which had struggled even as other sectors began to recover, has started to show meaningful signs of improvement. Increased activity in this sector will directly impact performance of CMBS, particularly those pools with sizeable exposure to hotels, and ABS backed by aircraft leases, timeshare loans, rental car fleet leases, and credit card loans. Read more.

![]() SFA Research Corner: Continued Jobs Improvement Supports Securitization – June 8, 2021

SFA Research Corner: Continued Jobs Improvement Supports Securitization – June 8, 2021

The May jobs report, while positive, reflects a labor market still dealing with the lasting effects of the pandemic. Improving labor market conditions support securitization. In a recent report, Moody’s viewed “fundamental risks for securitization assets as generally declining.” In contrast to 2020, in 2021, upgrade volume has surpassed downgrade volume. Read more.

SFA Research Corner: Helping Lenders Fund America’s Small Businesses – May 24, 2021

SFA Research Corner: Helping Lenders Fund America’s Small Businesses – May 24, 2021

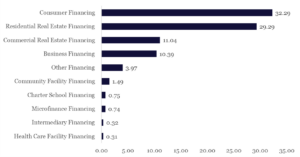

Small businesses represent nearly half of total employment in the U.S. and account for over 65% of net new job creation since 2000, according to the U.S. Small Business Administration. They are critical to local economies in both urban hubs and rural communities and play a key role in empowering minority and at-risk populations. Small business loan (SBL) securitizations may be issued by private lenders or offered through the one of three SBA lending programs – serve a common purpose – to increase the lending capacity of lenders and provide small businesses with reliable access to capital. Read more.

SFA Research Corner: Lending Conditions, One Step Forward, and Jobs Data, Two Steps Back – May 13, 2021

SFA Research Corner: Lending Conditions, One Step Forward, and Jobs Data, Two Steps Back – May 13, 2021

Banks’ willingness to lend and demand for loans drive securitization volume. The Federal Reserve’s April 2021 Senior Loan Officer Opinion Survey on Bank Lending Practices indicates that both of these measurements improved in the first quarter of 2021. Weak jobs data, if sustained, may pose a challenge to the return of the more favorable lending environment that characterized the pre-pandemic period. Read more.

![]() SFA Research Corner: Confidence in CLOs Boosted by 2020 Resiliency and 2021 Economic Recovery – May 3, 2021

SFA Research Corner: Confidence in CLOs Boosted by 2020 Resiliency and 2021 Economic Recovery – May 3, 2021

Stronger than expected first quarter activity and a pickup in vaccine distribution have resulted in more optimistic outlooks. Based on a stronger and sustained economic recovery, S&P Global Ratings has lowered its projected S&P/LSTA Leveraged Loan Index issuer default rate to 2.75%, which bodes well for CLOs performance in 2021. Moreover, “[t]he resilience of CLOs through the 2020 downturn has bolstered confidence in the asset class,” explains Steve Andergerg Managing Director and CLO Sector Lead at S&P Global Ratings. Read more.

SFA Research Corner: Serving the Underserved – April 28, 2021

SFA Research Corner: Serving the Underserved – April 28, 2021

Community Development Financial Institutions are private financial institutions whose primary mission is to support community development by providing financing to low-income, low-wealth individuals — a population that has been historically underserved by traditional lenders. By including CDFI loans in securitized pools, securitization is an important funding tool that can connect investment capital to underserved communities. Read more.

SFA Research Corner: Trends in Auto ABS – April 20, 2021

SFA Research Corner: Trends in Auto ABS – April 20, 2021

Used vehicle prices rose 5.87% to 179.2 in March, as reported by the Manheim Used Vehicle Index. March’s value is 26% above its level one year ago and is a record high for the Index. Robust used car prices limit the severity of losses in auto ABS portfolios. We review these and other market trends in auto ABS. Read more.

SFA Research Corner: Revolving Debt and Credit Card ABS – April 14, 2021

SFA Research Corner: Revolving Debt and Credit Card ABS – April 14, 2021

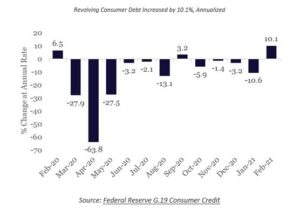

Revolving consumer debt, which primarily represents credit card balances, rose $8 billion in February to $974.4 billion, the largest month-over-month increase of this measure since 2019 according to the Federal Reserve’s G.19 Consumer Credit Report. We look at how increased spending has been supportive of credit card ABS. Read more.

SFA Research Corner: A Tale of Two Mortgage Markets – April 7, 2021

SFA Research Corner: A Tale of Two Mortgage Markets – April 7, 2021

On April 2, the Wall Street Journal reported that while “[t]he mortgage market is humming … getting approved for a home loan is as difficult as it has been in years.” We take a look at these credit trends and the impact of stubbornly high jobless numbers. Read more.

SFA Research Corner: March Came in Like a Lion for LIBOR Transition – March 30, 2021

SFA Research Corner: March Came in Like a Lion for LIBOR Transition – March 30, 2021

With essentially nine months remaining before issuing securities tied to USD LIBOR creates “safety and soundness risks”, regulators, government officials, and market participants strongly re-committed their efforts to a successful LIBOR transition. We highlight the key points of these developments below and track the progress of SOFR adoption in the securitization markets. Read more.

SFA Research Corner: After a Conscious Decoupling, Will There Be a Reconciliation? Unemployment and Credit Performance Post-COVID – March 16, 2021

SFA Research Corner: After a Conscious Decoupling, Will There Be a Reconciliation? Unemployment and Credit Performance Post-COVID – March 16, 2021

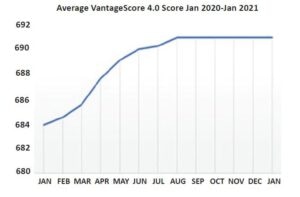

Pre-COVID, consumer loan performance tracked unemployment closely. This relationship decoupled in 2020. “We have seen credit scores moving up following the onset of pandemic, largely reflecting more conservative use of credit and changes in reported delinquencies due to the presence of accommodations,” explains Emre Sahingur, head data scientist at VantageScore Solutions. As scores have plateaued, Sahingur warns, however, that a “a closer examination of the data reveals some early signs of reversing trends.” Consumer credit in a post-COVID environment will be discussed further at SFA’s March 18 webinar – Emerging From Suspended Animation – Consumer Credit and the Impact on ABS. We encourage you to join us as our panel of experts discuss the potential impact on ABS backed by auto loans and leases, credit cards, student loans and personal installment loans. Read more.

![]()

SFA Research Corner: The Electric Vehicle Market Charges Up – March 9, 2021

Car manufacturers have been adding full-electric and hybrid electric vehicles (EV) to their lineup to comply with global environmental regulations and to meet rising consumer demand. Pledges by major automakers to become fully electric as well as recent proposals from the Biden administration and lawmakers have the potential to meaningfully boost U.S. sales. For securitization, this could lead to an increase in stand-alone green auto ABS offerings or designated green buckets in traditional auto ABS deals, both of which would be welcomed by ESG investors. Read more.

![]() SFA Research Corner: Calls for Consistent, Comparable Climate-Related ESG Disclosures – March 2, 2021

SFA Research Corner: Calls for Consistent, Comparable Climate-Related ESG Disclosures – March 2, 2021

Over the past few weeks, the Federal Reserve, the SEC and the House Committee on Financial Services have addressed the challenges around climate-related disclosures. How these challenges are resolved in the broader markets will ultimately influence on how the structured finance markets address its own unique ESG-related reporting challenges, an effort led by SFA and its membership. Read more.

![]()

SFA Research Corner: Student Loan Forgiveness and ABS

– February 23, 2021

President Biden announced on February 16 that he was prepared to forgive $10,000 of federal student loan debt. While all borrowers of federal student loans would benefit to some degree, a blanket forgiveness of $10,000 would completely eliminate debt for over 15 million borrowers. The impact on ABS backed by FFELP loans will depend on the scope of loan forgiveness. Read more.

![]() SFA Research Corner: An Executive Order Seeks to Lift Pall on ESG Cast by DOL Rule – February 9, 2021

SFA Research Corner: An Executive Order Seeks to Lift Pall on ESG Cast by DOL Rule – February 9, 2021

The Biden administration will review a controversial Department of Labor rule that effectively dissuades employer-sponsored ERISA retirement plans, including 401(k) retirement plans, which holds an estimated $6.5 trillion in assets, from investing in ESG funds. The rule comes as the asset flows into ESG accelerate. We look at certain securitized products that can easily be included in the expanding ESG universe. Read more.

![]() SFA Research Corner: Households Expect To Spend More in 2021 – February 1, 2021

SFA Research Corner: Households Expect To Spend More in 2021 – February 1, 2021

The Federal Reserve Bank of New York’s Household Spending Survey reports that households expect their spending to grow by 3% in 2021, a sharp increase over the 2.2% reported August 2020 and the 2.4% in December 2019. The increase was broad based across education and income group. While this is welcome news for the economy, the outlook for certain business sectors will still depend on the course of the virus. Read more.

SFA Research Corner: Support for Households Continue – January 26, 2021

SFA Research Corner: Support for Households Continue – January 26, 2021

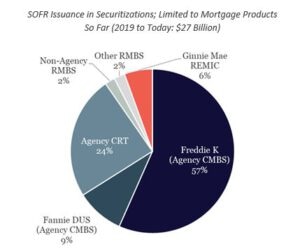

The Biden Administration has extended the payment moratorium on federally owned student loans for nine months. The executive order coincided with the FHFA’s announcement to extend Freddie Mac’s and Fannie Mae’s moratoriums on single-family foreclosures and real estate owned (REO) evictions until February 28, 2021. We expect both developments to have a positive impact on credit and consumer-related securitization overall. This month, we begin tracking the volume of securitized transactions indexed to SOFR. Read more.

![]() SFA Research Corner: Checking on Household Health After a Stressful Year – January 13, 2021

SFA Research Corner: Checking on Household Health After a Stressful Year – January 13, 2021

With a most extraordinary year behind us, we check on the credit health of U.S. households. Household’s financial health drives demand for credit to make purchases and, along with employment, impacts a borrower’s ability to repay debt. The securitization markets look to these metrics and others to better understand consumer demand for credit and changes to credit risk, a particular concern given the unevenness of the recovery. Read more.

![]() SFA Research Corner: Middle-Market CLOs Resilient in Early Days of Pandemic as Labor Market Point To Rough Days Ahead – December 7, 2020

SFA Research Corner: Middle-Market CLOs Resilient in Early Days of Pandemic as Labor Market Point To Rough Days Ahead – December 7, 2020

Strong structures helped middle-market CLOs weather the early days of the pandemic even as underlying corporate obligors struggled through the economic slowdown. Although economic activity has started to resume, a slowdown or reversal will challenge these companies, many of whom relied on government and private sector loans. Recent labor data shows that the impact of the disruption may last longer than originally thought. Read more.

![]() SFA Research Corner: Time to Take Off the Training Wheels? – November 23, 2020

SFA Research Corner: Time to Take Off the Training Wheels? – November 23, 2020

On November 18, the Office of Financial Research (OFR) submitted its Annual Report to Congress. The 177-page report concludes that “significant downside risks to financial stability persist amid high uncertainty” and that “[t]here remains a striking contrast between the quick recovery of financial markets and the slower recovery of the economy.” We take a brief look at some of these risks and the potential impact on consumers, corporations, and securitization. Read more.

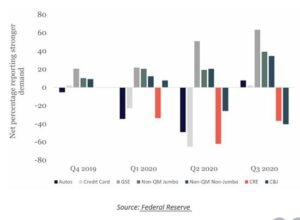

SFA Research Corner: Tightening Standards Continue Amidst Firming but Uneven Demand – a Look at the October Senior Loan Officer Fed Survey – November 16, 2020

SFA Research Corner: Tightening Standards Continue Amidst Firming but Uneven Demand – a Look at the October Senior Loan Officer Fed Survey – November 16, 2020

We take a closer look at the results of the October Senior Loan Officer Opinion Survey on Bank Lending Practices. Lending conditions remain tight. Loan demand has turned positive in the consumer sectors but remains weak for businesses. Read more.

![]() SFA Research Corner: Consumers May Find Themselves Between a Rock and a Hard Place – November 10, 2020

SFA Research Corner: Consumers May Find Themselves Between a Rock and a Hard Place – November 10, 2020

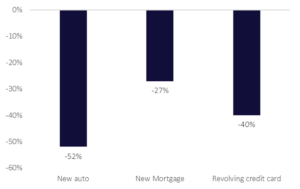

The combination of payment relief programs and unprecedented support through stimulus payments have kept loan delinquencies and defaults low despite elevated levels of unemployment. New data shows that while deferral programs were readily available and utilized at the onset of the pandemic, this is not the case today. If recent labor market gains slow with rising COVID-19 cases, and the likelihood of a generous stimulus package disappears with a split Congress, some borrowers may find themselves caught between a rock and a hard place. Impacted households forced to reprioritize their wallet may leave some lenders unpaid, a trend that we are starting to see in auto loans. Read more.

![]() SFA Research Corner: The Road Back – Positive Macro Trends Support Auto ABS – November 2, 2020

SFA Research Corner: The Road Back – Positive Macro Trends Support Auto ABS – November 2, 2020

Third quarter data shows that the economy is coming back strongly but rising COVID cases and the absence of another stimulus package threatens this trajectory. We look at recent macro developments and the impact this has had on auto financing. Read more.

![]() SFA Research Corner: Joblessness and Credit Scores Improve as Consumers Buckle Down – October 26, 2020

SFA Research Corner: Joblessness and Credit Scores Improve as Consumers Buckle Down – October 26, 2020

A recent post from Liberty Street Economics shows that households have used more of their government stimulus and unemployment benefits to pay off debt and to build savings rather than on consumption. This shift in preference, if it continues, will have implications for the broader economy. Read more.

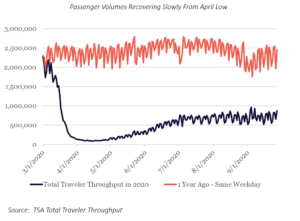

SFA Research Corner: Aircraft ABS Buffeted by COVID-19 Turbulence – October 13, 2020

SFA Research Corner: Aircraft ABS Buffeted by COVID-19 Turbulence – October 13, 2020

The airline industry has been one of the hardest hit industries since the onset of the pandemic. While air travel has recovered from April’s low, passenger demand has remained depressed as passengers, airlines, and governments navigate quarantine mandates, staggered re-openings, and still rising COVID-19 cases. The downward pressure on cashflows have impacted aircraft ABS resulting in downgrades across the space. Read more.

SFA Research Corner: Macro Data Continues To Show a Slowing Recovery as Securitization Market Reports Strongest Month of Activity Since Onset of Pandemic – October 5, 2020

SFA Research Corner: Macro Data Continues To Show a Slowing Recovery as Securitization Market Reports Strongest Month of Activity Since Onset of Pandemic – October 5, 2020

Troubling labor market trends persist even as unemployment rate improves for the fifth consecutive month. Meanwhile, new BEA data shows households retrenched in August in reaction to the expiration of supplemental unemployment benefits. These developments may weigh heavily on securitization going forward. However, for now, the securitization market benefits from robust new issue activity and still-strong investor demand. Read more.

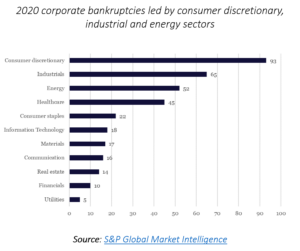

SFA Research Corner: Corporate Bankruptcies Hit Highest Levels in 9 Years – September 28, 2020

SFA Research Corner: Corporate Bankruptcies Hit Highest Levels in 9 Years – September 28, 2020

S&P Global Market Intelligence reports that corporate bankruptcies totaled 470 between January and September 2020, the highest number of filings for any comparable period in the past 9 years. Of these, 36 were so-called mega-bankruptcies as these companies had more than $1 billion in liabilities at the time of filing. Consumer discretionary, industrials and energy sectors led bankruptcy filings. Read more.

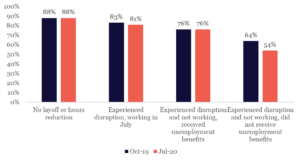

SFA Research Corner – September 22, 2020

SFA Research Corner – September 22, 2020

The Fed’s newly released Update on the Economic Well-Being of U.S. Households: July 2020 Results shows that Americans “experiencing employment disruptions were disproportionately likely to have difficulty paying bills, on average.” While data continues to show some real improvements in the labor market and federal financial assistance has provided much needed support to the unemployed worker, heightened uncertainty remains, as noted by Federal Reserve Chair Powell at the September FOMC meeting. Read more.

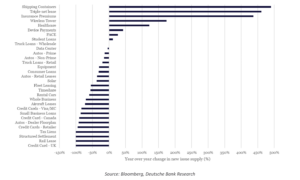

SFA Research Corner – September 14, 2020

SFA Research Corner – September 14, 2020

Although the supply of new bonds overall is down by about one-third from 2019, a closer look at the underlying data shows that the decline across asset classes have been far from uniform with some niche sectors seeing strong activity. Read more.

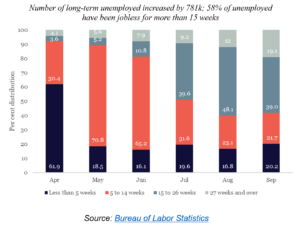

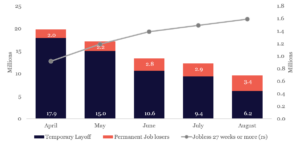

SFA Research Corner – September 8, 2020

SFA Research Corner – September 8, 2020

The headline unemployment rate fell to 8.4% in August as 1.4 million jobs were added. Improvements in the headline rate belie some troubling trends, namely a rise in the number of persons with permanent job loss and longer duration of unemployment. Read more.

SFA Research Corner – August 31, 2020

SFA Research Corner – August 31, 2020

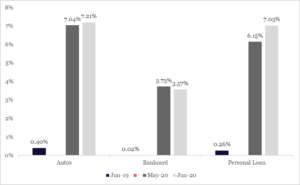

TransUnion’s Monthly Industry Snapshot shows the total percentage of accounts in “financial hardship” status dropped during the month of July, although remains well above pre-pandemic levels. Bankcards show the most decline, dropping 20%, and personal loans, the least, down 1.6%. Read more.

SFA Research Corner – August 3, 2020

SFA Research Corner – August 3, 2020

Although the monthly enrollment rate has slowed significantly, the percentage of accounts in payment relief programs rose to unprecedented levels in May and remained at elevated levels in June. The take-up rate differs by asset class – mortgages, autos, and personal loans have higher participation rates than bankcards. Read more.

SFA Research Corner – July 28, 2020

SFA Research Corner – July 28, 2020

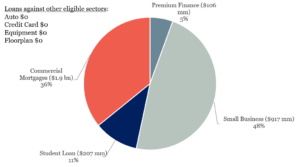

As of July 21, the third subscription date, total TALF loan requests have reached $1.9 billion, with almost half of that going to finance the purchase of securitizations collateralized by loans made under the U.S. Small Business Administration’s 7(a) and 504 loan programs, which may include PPP loans. Loans for the purchase of CMBS, premium finance ABS (which are backed by loans to finance property and casualty insurance) and private student loan ABS comprise the remainder. Absent from this list are loans to purchase ABS backed by autos, credit cards, equipment loans and dealer floorplan loans as these sectors have recovered significantly since the end of Q1. Read more.

SFA Research Corner – July 20, 2020

SFA Research Corner – July 20, 2020

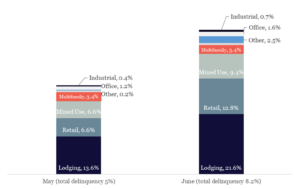

CMBS delinquency rates ratcheted higher in June. Kroll Bond Rating Agency reports that the overall delinquency rate for KBRA-rated CMBS jumped 64% from 5% in May to 8.2% in June. While deteriorating performance has been expected, some commercial real estate segments have been impacted more than others. Read more.

SFA Research Corner – July 13, 2020

SFA Research Corner – July 13, 2020

While re-openings have restored some jobs and incomes, the resurgence of the virus is having a negative impact on consumer demand. Read more.

SFA Research Corner – June 30, 2020

SFA Research Corner – June 30, 2020

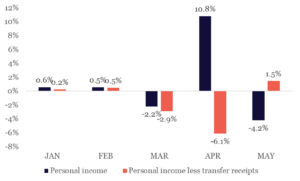

As of June 13, over 19.5 million Americans drew unemployment benefits. Since the enactment of the CARES Act in March, these benefits have been more generous in terms of quantity and duration. A person who files for unemployment today may be able to receive benefits until the end of the year. For some of those weeks, the unemployed worker will receive a substantially higher amount than what is received through regular unemployment benefits. These unemployment benefits and other government sponsored payments have had a substantial impact on personal income. If the jobs do not return to pre-COVID levels, what happens to the consumer when these programs expire? Read more.

SFA Research Corner – June 22, 2020

SFA Research Corner – June 22, 2020

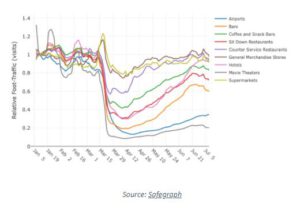

The COVID-19 pandemic continues to evolve rapidly. Traditional indicators that track economic and industry performance on a monthly or quarterly basis provide a less-than-complete picture of where we’ve been, much less of where we’re heading. As we enter a new stage of the pandemic, with new coronavirus cases rising and municipalities poised to implement new targeted shutdowns, we look at two high frequency data sources to better understand the impact of the pandemic on real economic activity. Read more.

SFA Research Corner – June 15, 2020

SFA Research Corner – June 15, 2020

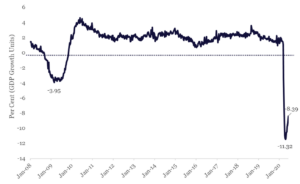

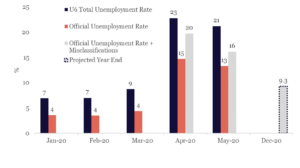

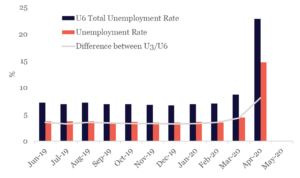

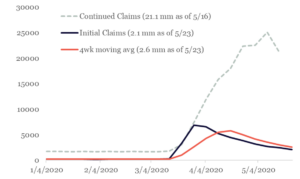

The ABS market continued its rally last week as some secondary market spreads approached the tightest levels of the year. For the first week of June, the primary market issued $6 billion of bonds financing a diverse mix of corporate and consumer loans. The jobs picture remains bleak, but improving. Weekly initial jobless claims show that another 1.5 million Americans became unemployed in the week ending June 6. On net, nearly 20 million jobs have been lost since February, according to Fed Chair Powell. The Fed expects the unemployment rate to fall to 9.3% by year end, from today’s rate of 13.3% (or 16.1% if misclassified unemployed individuals are included in the calculation). Read more.

SFA Research Corner – June 8, 2020

SFA Research Corner – June 8, 2020

By far the biggest news last week was the surprising improvement in the headline unemployment rate, which dropped from 14.7% in April to 13.3% in May, thanks to the addition of 2.5 million jobs. The May headline better is far better than the expected consensus of 19.8%. Some of the disparity maybe explained by a misclassification of data; the BLS has noted that absent this misclassification the May unemployment rate would have been 16.1%. The secondary securitization markets continued to improve with the most liquid of the ABS asset classes returning to early-January levels and other asset classes continuing their march towards pre-COVID levels. Read more.

SFA Research Corner – June 1, 2020

SFA Research Corner – June 1, 2020

April’s weak housing data reflects a market reeling from COVID-related demand shocks while April delinquency and forbearance data shows the effects of joblessness. Given the correlation between unemployment and the housing market and mortgage performance, any sustainable improvement will depend on how quickly and definitively jobs will come back, which is perhaps why the improvement in continuing claims, the first improvement since the pandemic outbreak, may be the first glimpse of the light at the end of the tunnel. Read more.

SFA Research Corner – May 18, 2020

SFA Research Corner – May 18, 2020

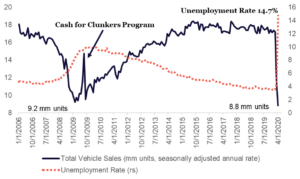

Another 2.9 million Americans became newly unemployed for the week ending May 9. With output expected to remain constrained for the remainder of the year, high unemployment is likely until then, according to the Congressional Budget Office. High joblessness has pushed demand for new autos to new lows. Read more.

SFA Research Corner – May 8, 2020

SFA Research Corner – May 8, 2020

After falling for 10 consecutive years, we are now facing a level of joblessness not seen post World War II. While the employment carnage is slowing – the current level of initial unemployment claims is less than half of the level recorded five weeks ago – the impact on consumer credit is just beginning to be revealed. Read more.

SFA Research Corner – May 1, 2020

SFA Research Corner – May 1, 2020

With a few exceptions, the primary and secondary markets for TALF-eligible ABS continued to see improvements. CLOs, in particular, have been under pressure as rating downgrades on loan collateral reach new highs. New issuance reached $13 billion in April, a drop of 76% from one year ago. For the year, issuance across RMBS, ABS, CMBS and CLOs is down 30%. Read more.

SFA Research Corner – April 23, 2020

SFA Research Corner – April 23, 2020

The conditions in the primary and secondary ABS markets continue to improve. We expect to see the impact of joblessness, forbearance and deferrals in ABS/ RMBS portfolios in the coming weeks. Read more.

SFA Research Corner – April 16, 2020

SFA Research Corner – April 16, 2020

Announcing the inaugural edition of the Research Corner, where we track the performance on the consumer and business lending that our market finances and the economic impact of the structured finance industry, including market movements and macro signals that impact our members. Read more.