Research Corner

Tracking market movements and macro signals that impact our members, and the performance of businesses and consumers that our market supports

Search research pieces

SFJournal: Trading as a Service:Turning SP Trading Back into a Strategic Growth Engine for Banks

Post–Global Financial Crisis reforms increased the capital cost of holding credit risk, prompting banks to scale back capital-intensive trading activities. This paper introduces Trading as a Service (TaaS) as a complementary approach to the traditional dealer model, embedding more consistent, deal-specific market-making alongside investment banking. The framework seeks to improve liquidity, price transparency, and secondary support while better aligning trading and banking incentives within existing regulatory constraints.

Featuring

The SFA KnowledgeHub

SFA’s Research Corner beta release of the SFA KnowledgeHub, a flexible data platform created to acquaint non-members with pertinent information and provide members with swift access to vital industry data sources.

SFA Research Pieces

SFAcademy: The Bootcamp Series

January 20, 2025

The Structured Finance Association (SFA) has launched a new structured finance education program, the SFAcademy. Every other week, new content will be added to our inaugural Bootcamp Series. Our Modules are designed to introduce the fundamentals of securitization and various securitized asset classes through accessible explanations and real-life examples to practitioners of all levels.

Amount Funded By

Our Market

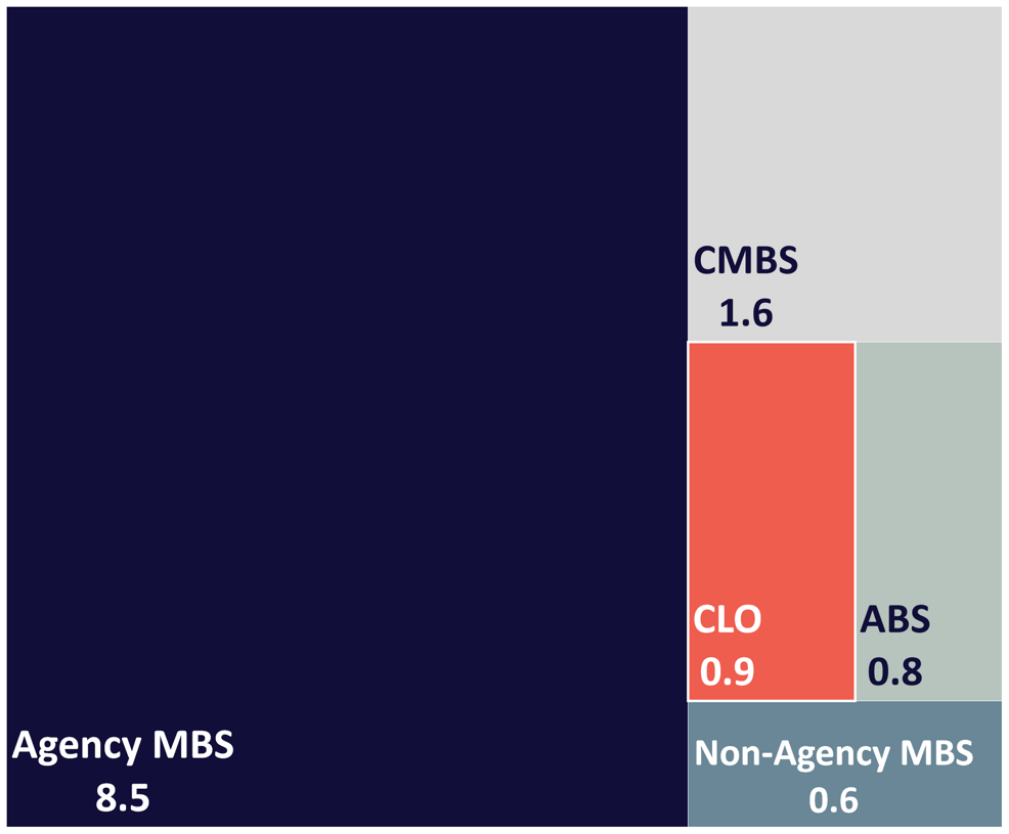

Total Securitizations Outstanding in Trillions (Year-End 2020)

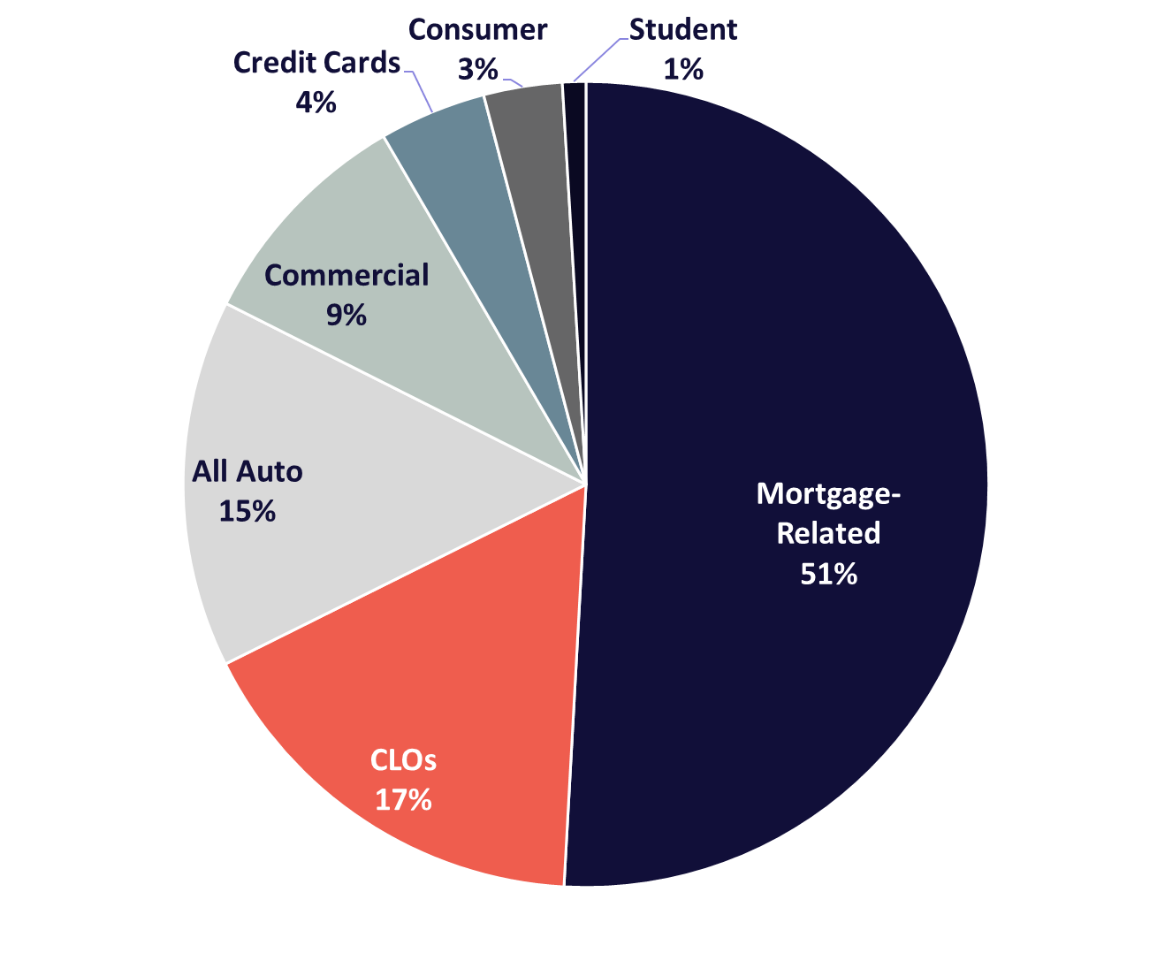

Total 2022 YTD Private Market Securitization $745 Billion

In The News

SFA CEO Michael Bright Testifies Before the House Financial Services Committee

On February 11, 2026, Michael Bright was a panelist in a congressional hearing entitled “Homeownership and the Role of the Secondary Mortgage Market.” https://youtu.be/HH9L–BLuWE

Pricing Risk: The Credit Score Effect

In the latest episode of SFA’s Bright Ideas Podcast, Dallin Merrill, Head of Policy at SFA, sits down with Devin Norales, Head of Mortgage and…

CLO Issuance and the Use of Captive Equity Funds Increase

According to Bloomberg, CLO issuance has hit record levels, largely due to the increased use of captive equity funds (investment funds that are fully controlled…

U.S. Job Growth Shows Largest Increase in Over a Year

Based on a February 11 release from the Bureau of Labor Statistics (BLS), the Wall Street Journal reports the strongest job growth since December 2024 with 130,000 jobs added…

FHFA Looks to Repeal Fair Lending Rule

The Federal Housing Finance Agency (FHFA) is continuing with its proposed repeal of the Biden Administration’s Fair Lending, Fair Housing and Equitable Housing Finance Plans regulations. This…