Taking Steps To Protect Student Loan Financing From a Rocky LIBOR Transition

Provided by Structured Finance Association

Without clarity around a replacement for the London Interbank offered rate, or LIBOR — which underpins millions of student loans and will be phased out in 2021 — certain asset-backed securities backed by loans made under a federal education loan program could experience a disruption. And that could lead to ratings volatility for certain student loan asset-backed securities.

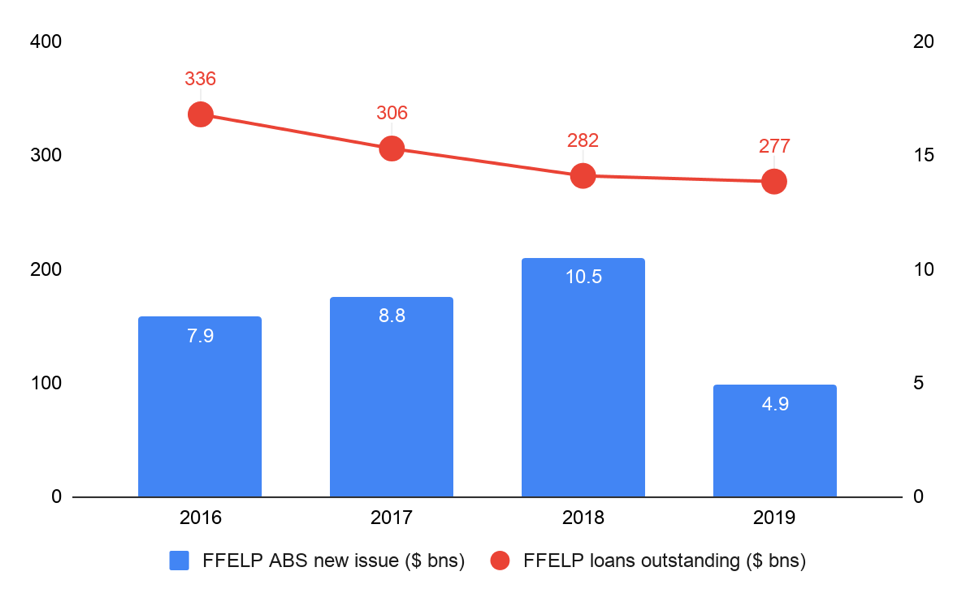

The Education Finance Council (EFC) is working with other student loan industry leaders on a legislative solution that would transition the subsidy — called the Special Allowance Payment — paid to lenders on student loans originated under the Federal Family Education Loan Program, or FFELP, away from LIBOR. The replacement rate is yet to be determined; the secured overnight financing rate, or SOFR, is a candidate. Creating a transition plan via legislation will, in EFC and SFA’s view, minimize the potential disruption of income for 13 million FFELP borrowers with $277 billion in outstanding loans.

Although FFELP stopped originating loans in July 2010, after the passage of the Health Care and Education Reconciliation Act, the loan portfolios still exist. And new issues of asset-backed securities collateralized by FFELP loans have continued, driven by refinancing and continued demand for these high-quality securities.

EFC and SFA are members of the Federal Reserve’s Alternative Reference Rate Committee, which is tasked with finding ways to deal with the LIBOR transition. The two organizations hosted a call in December to inform the education finance industry about how the transition away from LIBOR could impact the student loan asset-backed security market. EFC has two main concerns:

- The impact of the LIBOR replacement on legacy FFELP asset-backed security bonds that pay a LIBOR-based floating rate coupon.

- The impact on cash flow generated by LIBOR-based FFELP Special Allowance Payments. The U.S. Department of Education pays this subsidy on low-interest, long-term student loans to ensure a minimum yield. The yield is calculated quarterly, based off 1-month LIBOR, 3-month commercial paper or T-bills.

FFELP loans carry a 97-100% government guarantee. That means the primary risk factor for a FFELP asset-backed pool is timeliness of cash flow, which is generated by special allowance payments and interest subsidy payments on the underlying loans as well as default reimbursement. The rating agencies currently account for brief temporary disruptions to cash flow when rating FFELP asset-backed securities.

As SFA focuses on developing LIBOR solutions for legacy transactions in 2020, we will continue to convene our members to share information among market participants and promote solutions such as the legislative fix EFC seeks for the Special Allowance Payment for FFELP asset-backed securities.

If you would like to join the LIBOR task force, please contact Hunter Hamrick at hunter.hamrick@structuredfinance.org.