SFA Research Corner: The Fed Takes Sweeping Actions

article by Structured Finance Association

By: Elen Callahan

On Sunday, March 15, the Federal Reserve took extraordinary emergency steps to address potential market disruptions arising from the coronavirus outbreak.

- To encourage liquidity and stability in the U.S. financial system, the Fed lowered the target range for the fed funds rate to 0-0.25%, the second emergency rate cut in March.

- Additionally, on March 16, the NY Fed conducted additional repo operations at 1:30 PM ET – these actions were again for up to of $500 billion with a minimum bid rate of 0.10 percent.

- To encourage stability in the global financial system and to smooth the functioning of the entire Treasury market, the Fed announced plans to repurchase at least $500 billion of Treasury securities over the coming months.

- Additionally, to further support the flow of credit and the ability for individuals to buy a house or refinance their mortgage, the Fed announced that they will buy back at least $200 billion of MBS over the coming months. Together these actions re-ignite Quantitative Easing, the monetary policy that was used by the Fed to increase the domestic money supply and restore smooth market functioning after the financial crisis of 2008.

- To further support the flow of credit to individuals and households, the announcement will make it easier for banks to take advantage of the Fed’s main lending facility and at meaningfully lower interest rates. The Fed cut the interest rate on discount window loans by 1.50%, bringing that rate to 0.25%, and has opened borrowing terms for up to 90 days from overnight. Loans are prepayable and renewable by the borrower on a daily basis. The discount window is the Fed’s secured lending facility for commercial banks. The Fed is also encouraging the use of its intraday credit facility, which provides liquidity on a secured or unsecured basis.

- In another policy reversal, the Fed eliminated bank reserve requirements for all institutions effective March 26. By removing this requirement, $1.6 trillion will be made immediately available for loans to households and businesses.

- And last but certainly not least, on a more global front, the Fed is coordinating with five central banks to reduce the pricing on standing dollar liquidity swap lines to encourage and maintain unimpeded flows or credit between countries. The swap lines improve liquidity conditions in dollar funding markets in the United States and abroad by providing foreign central banks with the capacity to deliver U.S. dollar funding to institutions in their jurisdictions during times of market stress. The central banks participating, the Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, and the Swiss National Bank, will also be able to offer dollars to institutions in their jurisdictions for a term of 84 days, in addition to the usual one-week operation.

The sweeping action by the Fed seeks to limit the impact of what is expected to be a broad-based severe curtailment of economic activity due to the coronavirus outbreak. Under normal conditions, consumers and businesses applying for new loans or refinancing existing loans would benefit from the low interest rates. Banks would also be incentivized to lend given the more accommodative lending conditions. Consumer and businesses holding existing floating rate loans would benefit from lower debt burdens as their loans reset to the lower rates. In today’s environment, however, this is all predicated on getting through the coronavirus outbreak in a timely way.

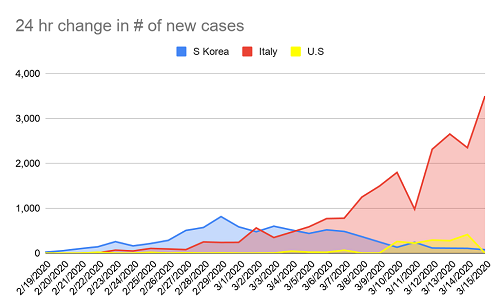

Most market participants agree that once the coronavirus is behind us, yesterday’s policy changes will support economic recovery. We are mindful, however, that the current uncertainty is extreme and the duration and magnitude of the slowdown difficult to quantify. The speed of recovery will be determined by how quickly human behavior can change to effectively slow the spread. The fact that this response can vary greatly is evident in the recent experience of coronavirus-impacted countries. Our graph below shows the number of new confirmed cases in South Korea, Italy and the U.S. Following aggressive containment measures, the number of new cases in South Korea peaked on February 29 and has declined meaningfully. In Italy, where containment measures were slow to take effect, we continue to see a rising number of confirmed new cases.

SFA will continue to monitor this fast-evolving situation and its impact on the securitization markets.