SFA Co-Chaired ARRC SWG Options for Using SOFR in New ABS, MBS, and CMBS Products

article by Structured Finance Association

Main Takeaway

Under SFA’s leadership market participants across the market developed one industry-consensus option for how a successful SOFR-based securitization product could use average SOFR, with interest rates determined prior to the commencement of the interest accrual period (e.g. an “in-advance” interest calculation convention) to help encourage consistency in market interest calculation conventions, stabilize the market during the LIBOR cessation and reduce systemic risk.

Background

The Alternative Reference Rates Committee (ARRC) is a group of private-market participants convened to help ensure a successful transition from USD LIBOR to the Secured Overnight Financing Rate (SOFR), a more robust reference rate and the ARRC’s recommended alternative.

As a Co-Chair of the ARRC’s Securitizations Working Group (SWG), which is tasked with developing recommendations to help the ARRC facilitate discussion and make informed decisions, SFA has an instrumental role in helping to enable a smooth transition.

Towards the end of 2020, the ARRC asked the SWG to identify the key considerations relevant to developing new issuance of securitized products based on SOFR. SWG members include representatives of issuers, underwriters, arrangers, trustees, servicers, calculation agents, note administrators, trust administrators, investors, and other market participants.

The SWG members participated in a months-long process sharing insights and perspectives on market participants’ operational needs, investor preferences, and other related market conventions including the derivative and loans markets in reaching a consensus view on one option for the use of SOFR in ABS, MBS, and CMBS products.

SFA’s Key Points

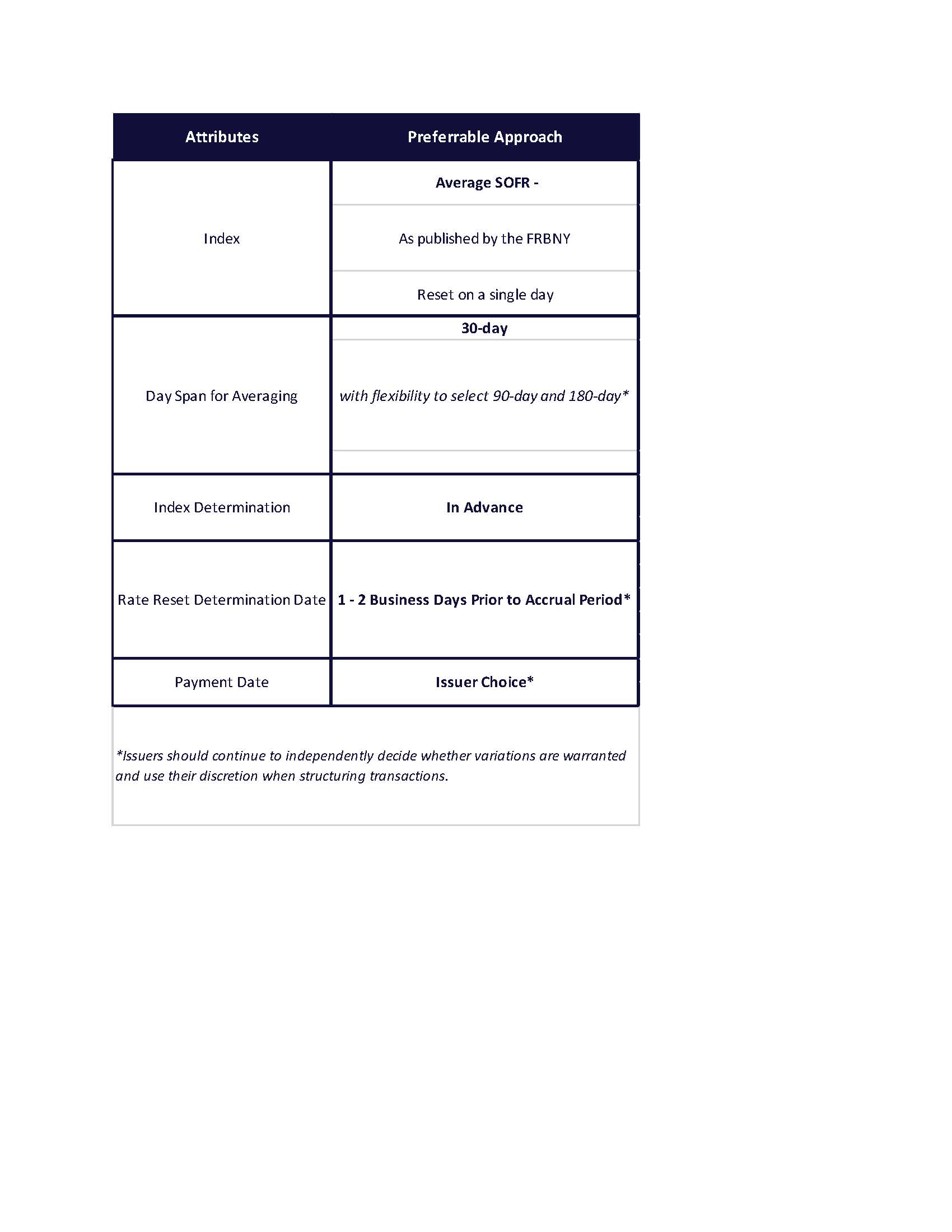

The preferred approach for most transactions includes the below attributes: