SFA Research Corner: Data Dissonance – Official Unemployment Rate Improves in June as Permanent Job Losses Increase; Weekly Initial Jobless Claims Remain Stubbornly Elevated

article by Structured Finance Association

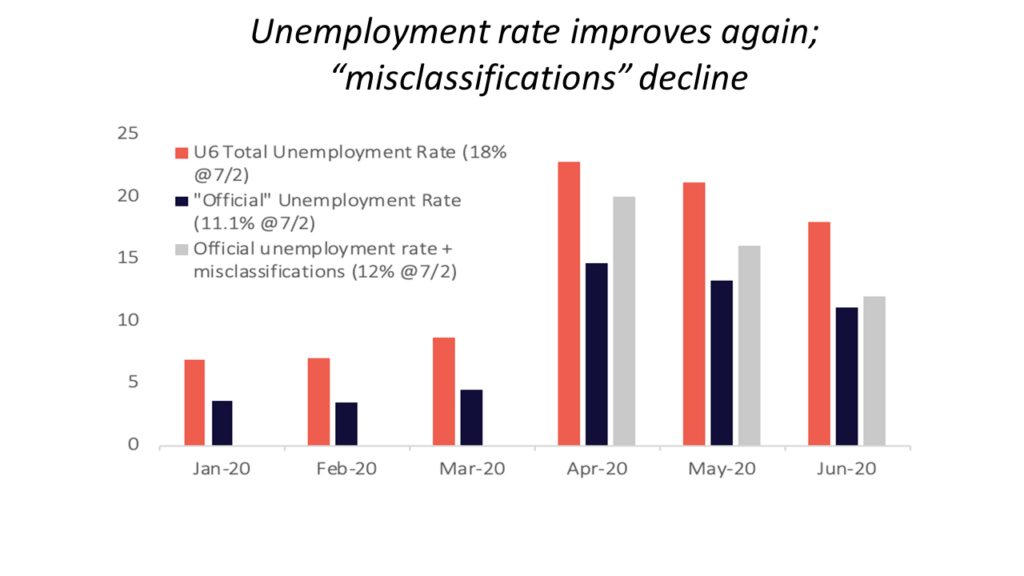

The official unemployment rate declined to 11.1% in June from 13.3% in May, as employment in leisure and hospitality rose sharply, the U.S. Bureau of Labor and Statistics reported. The total unemployment rate, or the U6 unemployment rate and includes all persons marginally attached to the labor force, plus total employed part time for economic reasons, dropped to 18% from 21.2% in May. The Bureau noted that while the metric still included individuals who were misclassified as absent from work but employed rather than unemployed due to a temporary layoff, the degree of misclassifications “declined considerably” in June. The Bureau estimates that misclassifications would have added another 1% to the unemployment rate.

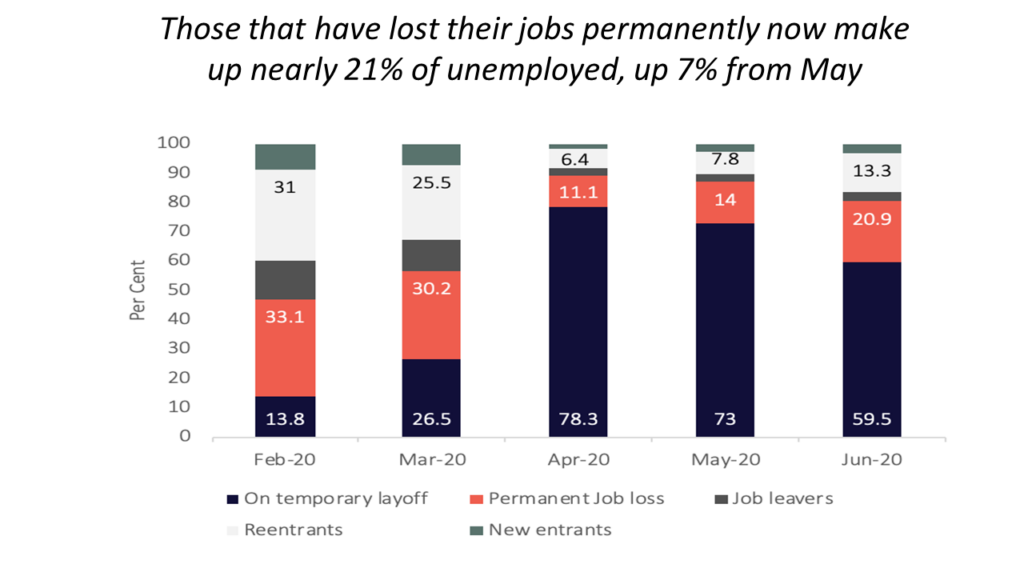

A closer look at the data shows that in June, almost 60% were on temporary layoff, a drop from 70% in May. While some of these individuals may find employment, others may lose their jobs permanently. In fact, 21% of June’s unemployed workers had lost their jobs permanently, shooting up from 14% in May. Additionally, the percentage of unemployment reentrants rose from nearly 8% in May to over 13% in June as persons who were not in the labor force prior to beginning their job search were perhaps incentivized by current levels of unemployment benefits.

Meanwhile, initial jobless claims, which is reported weekly, shows that for the week ending June 27 another 1.4 million Americans filed for unemployment insurance for the first time. This metric has remained stubbornly high, averaging 1.5 million over the past 4 weeks. During the week ending June 20, 19.3 million Americans were collecting unemployment benefits. Unemployed workers continuing to draw from the Pandemic Unemployment Assistance program numbered 12.8 million during the week ending June 13. For a discussion on the pandemic-related unemployment programs and its impact on personal income, please see our Research Corner. As we note in our weekly report, these programs, along with debt repayment programs offered by lenders, have directly and substantially helped unemployed workers bridge COVID-related financial hardships. However, the impact of even these programs are limited. SFA will continue to monitor the impact of the crisis on consumers and support the efforts of our members to provide consumer relief during these uncertain times.