The Fed Acts Again

Provided by Structured Finance Association

By: Jennifer Wolfe and Elen Callahan

Following March 15’s sweeping actions, and an injection of $1 trillion into the overnight repo markets over the past two days, the Fed stepped up once again – this time to support the $1.14 trillion commercial paper market. “Commercial paper markets directly finance a wide range of economic activity, supplying credit and funding for auto loans and mortgages as well as liquidity to meet the operational needs of a range of companies,” the Fed said in today’s announcement. “By ensuring the smooth functioning of this market, particularly in times of strain, the Federal Reserve is providing credit that will support families, businesses, and jobs across the economy.”

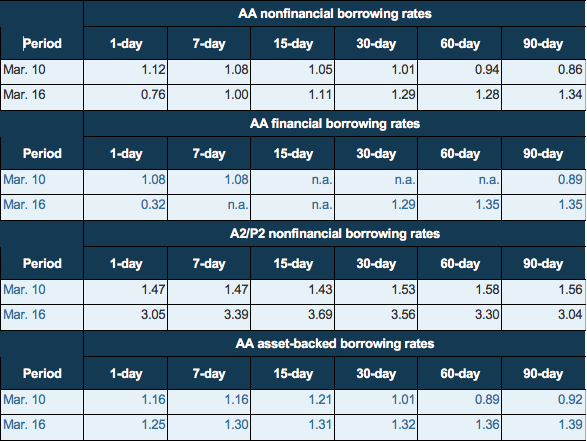

The Federal Reserve Board announced that it will establish a Commercial Paper Funding Facility (CPFF) to support the flow of credit to households and businesses. This is a direct response to the decreased liquidity in the commercial paper (CP) market over the past week, with CP borrowing rates rising considerably across sectors (see table below), and investors calling on the Fed to step in to address the market dislocation. Specifically, the Fed opened up the commercial paper funding facility under section 13(3) of the Federal Reserve Act, which enables it to support the real economy, rather than just the financial sector.

This move will facilitate the provision of credit for auto loans and mortgages, as well as liquidity to meet the operational needs of a range of companies. As described in the Fed statement, the CPFF will provide a liquidity backstop to U.S. issuers of commercial paper through a special purpose vehicle (SPV) that will purchase unsecured and asset-backed commercial paper rated A1/P1/F1 (as of March 17, 2020) directly from eligible companies. The Treasury will provide $10 billion of credit protection to the Federal Reserve in connection with the CPFF from the Treasury’s Exchange Stabilization Fund (ESF). The Federal Reserve will then provide financing to the SPV under the CPFF. Its loans will be secured by all of the assets of the SPV.

SFA will continue to monitor this fast-evolving situation and its impact on the securitization markets.

Please note this blog was updated on March 19th to reflect the complete ratings eligibility requirement of having two of the three (A1/P1/F1), versus the originally published A1/P1.