Helping Consumers Bridge Financial Hardship

Provided by Structured Finance Association

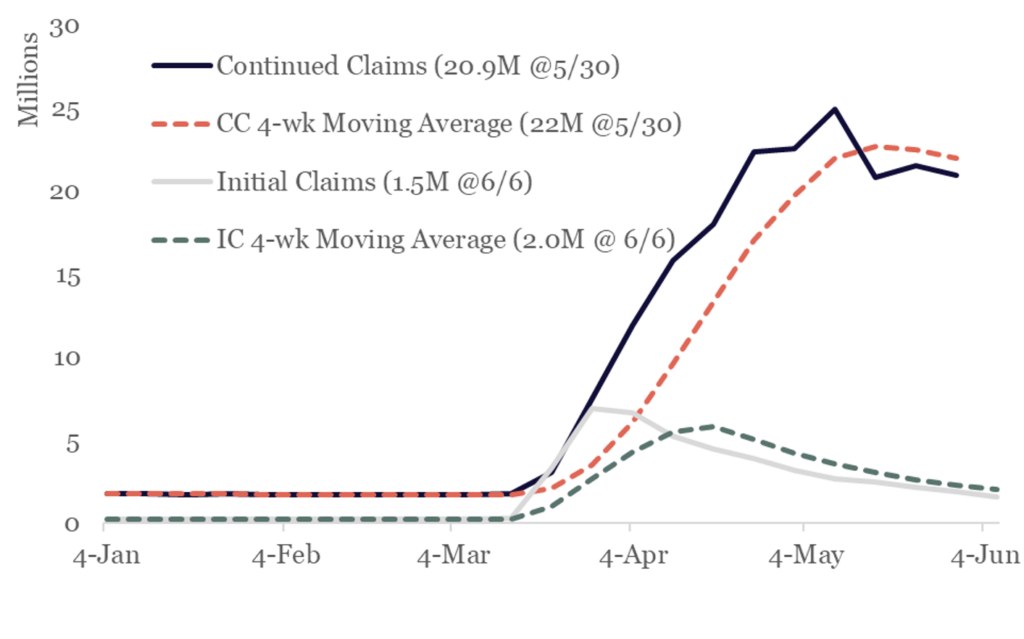

Since the onset of the COVID-19 pandemic in the U.S., over 44 million Americans have filed for unemployment since the U.S. declared the coronavirus pandemic a national emergency. The headline unemployment rate for May reached to 13.3%, as reported by the Bureau of Labor and Statistics, an improvement over April’s level of 14.7% but still well above the 9.8% high reached during the 2008 crisis. The U-6 total unemployment rate which includes the underemployed, the marginally attached (defined as persons who are neither working nor looking for work but indicate that they want and are available for a job and have looked for work sometime in the past 12 months) and discouraged workers stood at 21.2%.

Over 44 million Americans have filed for unemployment since March

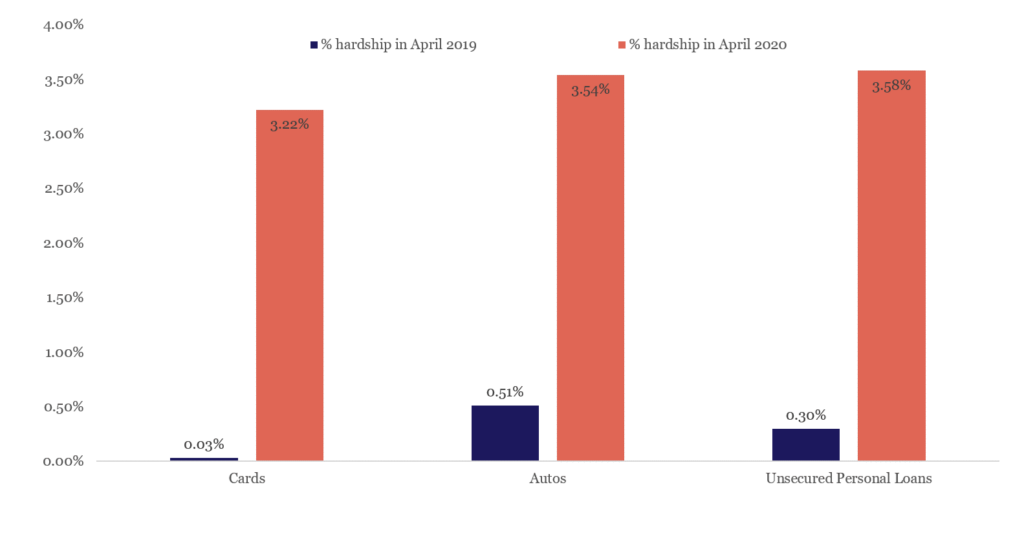

Given the scale of the economic dislocation, federal and state regulators encouraged financial institutions early and often to “work constructively with borrowers and other customers in affected communities”. As lenders quickly put programs in place, uptake has been meaningful. A new TransUnion Study shows that in the month of April alone, lenders provided consumer relief on nearly 15 million credit cards, 3 million auto and 837,000 unsecured personal loans. This represents 3.2% of all the card, auto and personal loans for the month and a significant increase from 2019 levels.

Lenders provided consumer relief on nearly 19 million consumer loans in April

Payment relief programs have been viewed as “positive and proactive actions that can manage or mitigate adverse impacts on borrowers, and lead to improved loan performance and reduced credit risk”. This guidance was codified in the CARES Act and permits institutions to offer consumers impacted by the pandemic some degree of payment and credit relief. These “accommodations” are defined as “an agreement to defer one or more payments, make partial payments, forbear any delinquent amounts, modify a loan or contract, or any other assistance or relief granted to a consumer who is affected by the coronavirus disease 2019 (COVID-19) pandemic.” Moreover, Section 4013 of the CARES Act, allows financial institutions to suspend the requirements to classify certain loan modifications as troubled debt restructurings (TDRs) while Section 4021 imposes new reporting requirements on creditors, thereby modifying the Fair Credit Reporting Act. Under section 4021, creditors will suspend a consumer’s account status (i.e., current or delinquent) at the time that the accommodation began, protecting consumers from the impact of nonpayment on their credit report. The new reporting guidelines apply retroactively from January 31, 2020 through either July 25, 2020 (120 days after the law was enacted), or 120 days after the date the COVID-19 national emergency declaration is terminated. To underscore the importance of supporting consumers, individual states have started to expand consumer protections even further.

With the exception of Federally-backed mortgages and student loans, which are specifically included in the CARES Act, relief options differ by product and lender. Below we summarize the myriad of non-mortgage consumer credit relief options offered by lenders below and the expected impact on the consumer ABS securities that finance these loans.

Credit Card

To quickly respond to customer needs, credit card issuers/servicers are allowing customers to request assistance online or via secure messaging. This may account for the high take rate – in a recent Lending Tree Survey, 91% of credit cardholders who requested relief got it. Of those who asked, 67% received payment relief on every card they asked about, and another 24% got a break on some of their cards.

There is no suite of relief options that is common to all credit card issuers. Relief is generally short-term and consumers must proactively request assistance. Probably the most helpful to anyone who lost his/her job and is struggling to make timely payments, has been lenders’ willingness to allow consumers to defer payments. These decisions are typically reviewed on a case-by-case basis. In most instances interest will continue to accrue and will be added to the outstanding credit card balance. Prior to the national emergency announcement, lenders had already been willing to work with troubled borrowers. In some cases this meant waiving fees and reducing penalty APRs to help bring a delinquent consumer current. Lenders were also willing to change due dates in order to spread out payment obligations and give consumers more time to make payments.

As lenders begin to report the impact, it’s clear that the size of these programs have been substantial. As of April 19, 2020, American Express enrolled $8.5 billion of card loans and receivables through their Customer Pandemic Relief Program. Similarly, Discover Financial Services approved over 450,000 customers and $3.8 billion in receivables in their Skip-A-Pay program to help their customers through these difficult times.

Auto Loans and Leases

Many of the captive and non-captive finance companies, as well as banks, are offering some form of temporary consumer relief for their loan and lease customers. Relief is generally in the form of deferred or skipped payments, which offers consumers some period free of monthly loan or lease payments, with the missed payments then added to the end of the contracts, ultimately extending the overall contract. It’s worth noting that interest on the missed payments continues to accrue. Many lease customers who are nearing the end of their leases may also have the ability to extend their leases and have certain contract terms, such as residual values, adjusted accordingly. While some finance companies have explicitly outlined the details of their relief programs on their websites, others require consumers to contact their servicers to learn the options available to them.

One such company offering a deferral program is GMFinancial. Pre-pandemic, the company offered limited deferments. In March, GMFinancial began waiving their deferral policies and guidelines for customers impacted by the pandemic. Consequently, in March their payment deferral rate was 1.6% of retail finance receivables outstanding. A meaningful increase from the February level of 0.9%. The payment deferral rate for the month of April 2020 was 3.5%. The company expects that payment deferrals will remain elevated in the coming months. Another is Ford Credit. In response to the pandemic, Ford Credit extended 10% of their existing customer contracts through payment deferrals, due date changes and lease-end extensions. Away from captive finance companies, Wells Fargo provided 175,000 maturity date extensions for their commercial distribution and auto finance customers, representing approximately $6.3 billion of outstanding principal and interest.

Unsecured Personal Installment Loans

Relief efforts in unsecured personal loans have been typically in the form of short-term loan deferments. Lending Club’s hardship plans range from offering interest-only payments for a few months to skipping up to two total monthly payments. To facilitate the process, the lender launched a self-service tool to allow people to apply for a hardship plan online. As of March 30, Lending Club granted a hardship on less than 2% of total loans outstanding. By April 30 Skip-A-Pay deferrals had been provided to 11% of their outstanding personal loan portfolio.

Student Loans

Under the CARES Act, payments on federal student loans, including direct loans, Perkins loans and Federal Family Education Loans owned by the U.S. Department of Education, are automatically suspended from March 13 through Sept. 30, 2020 with no interest accruing during this period. Eligible federal loan borrowers do not have to make payments and their credit will not be impacted during this time.

Private student loans and Federal Family Education loans owned by private lenders, which comprise an estimated $130 billion in outstanding debt to over 8 million borrowers, are not included in CARES Act legislation. While many private lenders have agreed to some form of relief, the options aren’t nearly as comprehensive as those mandated under the federal program. Given that many of these loans have likely been securitized and sold to investors, the lenders/servicers face limitations on the relief programs they can offer. Private lender relief include forbearance for up to 90 days at a time, waiving of late fees, no negative credit reporting and the pausing of debt collection lawsuits for 90 days, but there is no uniform policy across all private lenders. In many instances interest will continue to accrue during forbearance. as it would during pre-COVID-19 days for both federal and private loans.

In its quarterly filing, Sallie Mae reported an increase in the forbearance rate of their private education loan portfolio from 3.8 percent at March 31, 2019 to 6.2 percent at March 31, 2020 due to an increase in forbearance granted to borrowers impacted by the pandemic.

Navient reported that forbearance in their private education loans portfolio increased to $1.6 billion or 6.9% at March month-end compared to 2.7% in December. As loans in forbearance continued to increase in April, to $2.8 billion as of April 15, the company acknowledged that they expected loans in forbearance to continue to increase for “some time” but at a slower rate than experienced in March and April.

These relief efforts are particularly noteworthy as low-income earners, with limited access to financial resources, have been twice as likely to lose their job during the pandemic, according to TransUnion. Indeed, a Fed survey shows that among people who were working in February, almost 40% of those in households making less than $40,000 a year had lost a job in March and another 6% had their hours reduced or took unpaid leave. The success of relief efforts will ultimately depend on the length and severity of the downturn. According to the same TransUnion study, lower income borrowers can only manage through an average of 5.9 weeks until they are unable to pay their bills.

Although credit performance is still strong across consumer ABS, we expect to see weaker performance going forward as high unemployment weighs heavily on a consumer’s ability and willingness to service their debt.

The 2008 crisis has shown us that for credit card ABS, a weak labor market will result in higher charge-offs, smaller or fewer payments and fewer card purchases. Although card ABS are structured to withstand the effects of multiple, simultaneous shocks lower payment rates as a result of widespread deferrals will challenge the flow of income into ABS trusts. This has become evident card ABS. The monthly payment rate for Fitch’s credit card ABS index reached 27.07% in May. This represents a 264 bp drop from April and a 404 bp drop from the Q1 average. If prolonged, this could ultimately delay the repayment of principal to the bondholders.

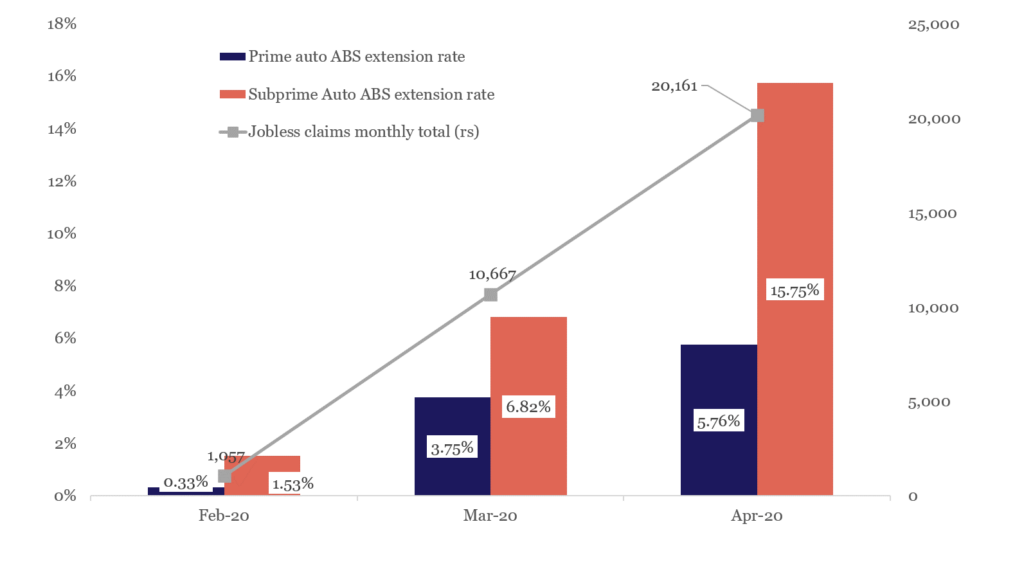

Consumer relief for auto loans has resulted in higher extension risk for auto ABS. New data from S&P Global shows extensions in auto ABS are on the rise as impacted borrowers worked with lenders on extension or deferral plans for their auto loans. The extension rate on auto ABS backed by prime loans rose from 0.33% in February to 5.76%, as the metric on auto ABS backed by subprime loans rose from 1.53% to 15.75%.

Auto ABS extension rate rise with jobless claims

as lenders provide payment relief to impacted borrowers

Despite these rising levels of risk, lenders have provided relief efforts as they have done in previous emergency disaster situations. Not only is it the right thing to do to help impacted individuals in a national emergency but accommodations also makes sound business sense. Forbearance and deferrals today will temper the severity of delinquencies and losses going forward. Since payment history is the most important factor in a personal credit score, by offering customers a much-needed bridge across the COVID chasm, lenders are helping troubled borrowers get through the pandemic with an intact credit score which translates into a healthier financial future. Along with expanded unemployment benefits and a one-time household rebate, these programs will be particularly supportive to creditworthy low and middle-income borrowers who are facing a reversal in their economic fortune. The troubled borrower who can successfully re-emerge on the other side may also mean a more loyal customer post-pandemic, and lenders will be uniquely positioned to help these customers by providing the access to credit that they need to rebuild.

SFA will continue to monitor the impact of the crisis on consumers across income groups and support the efforts of our members to provide consumer relief during these uncertain times.