Taking Stock of LIBOR-SOFR Progress

Provided by Structured Finance Association

LIBOR panelists at SFA’s well-attended Residential Mortgage Symposium took stock of the progress made on the LIBOR-SOFR transition. With no guarantee that the benchmark will exist beyond 2021, panelists agreed that a clear path forward will remain elusive until certain key issues are addressed, including the adoption of a replacement rate and clarity around fallback language. Recent discussions have been complicated by September’s repo market dislocation and volatility around SOFR, the chosen overnight replacement rate for LIBOR, and the critical starting point for this market transition.

Why SOFR?

The London Interbank Offered Rate, (LIBOR) is the oft-quoted benchmark for short-term interest rates, with terms ranging from one day to one year. With LIBOR quotes not guaranteed beyond 2021, the Alternative Reference Rates Committee (ARRC) has identified the Secured Overnight Funding Rate, (SOFR) as the preferred alternative. SOFR is based on the $1 trillion daily repo market of overnight and short-term cash loans collateralized by U.S. Treasury securities. Unlike LIBOR, which is based on the estimated borrowing rates as submitted by panel banks, SOFR is calculated as a volume-weighted median of transaction-level repo data and is published daily by the New York Fed. With these credentials, the market was taken aback in mid-September when the money markets experienced a jarring funding shortage and SOFR rates climbed well above the 2-2.25% Fed Funds target rate for the short-term money markets.

Mid-September was when “everybody became a repo trader”

Repurchase agreements, or repos, allow one firm to sell highly rated collateral to another firm with the agreement to buy back the security at some later date and at a pre-agreed price. Eligible securities include Treasury, agency debt and agency MBS. In September, a corporate tax payment deadline and the settlement of over $250 billion of Treasury debt sapped cash out of the market and pushed the cost of these overnight loans to new levels. Some have posited that conditions were exacerbated by bank reserve requirements tying up cash that banks would otherwise deploy into the repo market. Regardless of what confluence of events led to the liquidity crunch, market experts such as Jennifer Imler, Head of Funding and Capital Liquidity at Wells Fargo, “took solace” in knowing that the repo market did not grind to a halt and volume remained high. In her opinion, this spoke to the robustness of SOFR, specifically, and the repo market, in general.

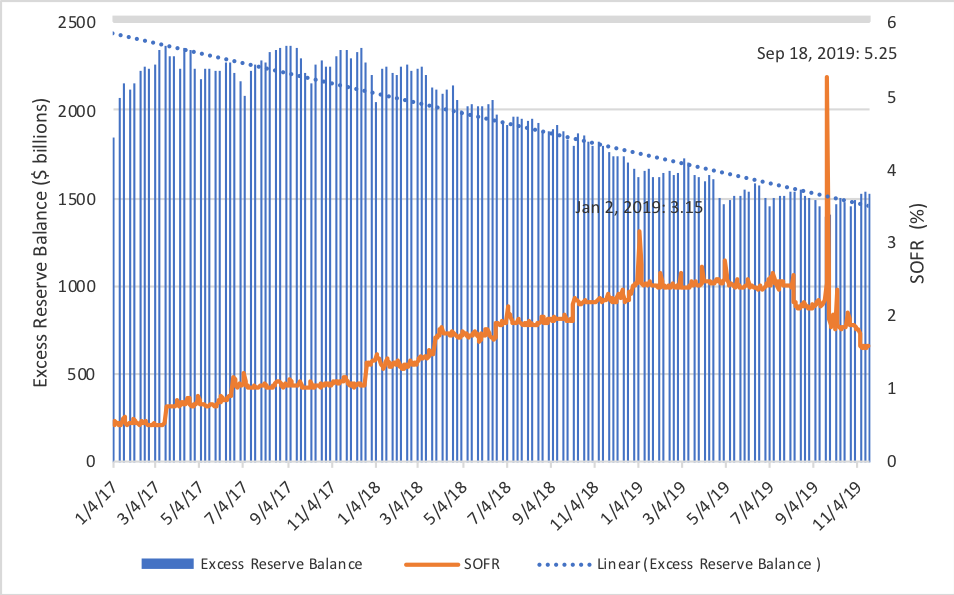

The Fed responded swiftly by conducting a series of overnight and term repo operations. More recently, the Fed, acting through the 24 primary dealers, announced that they will also purchase short-dated highly liquid Treasury bills at an initial pace of $60 billion per month. The moves address FOMC’s directive to “maintain reserves at or above early-September levels” of at least $1.5 trillion. Average reserves, published weekly by the Fed, fell to a period low of $1.39 trillion the week of September 18. As of November 20, the balance was $1.52 trillion and by year-end, participants expect to see reserves closer to $1.6 trillion. Historically, we’ve seen dips in excess reserve balance correspond to spikes in the overnight rate (see graph). The facility is expected to operate until at least 2Q 2020 with some market participants calling for a more permanent facility.

Dips in Excess Reserve Balance correspond to spikes in SOFR

Source: Board of Governors of the Federal Reserve System (U.S.), Federal Reserve Bank of NY

YE is the next test for SOFR

The New York Fed has reiterated that, despite recent volatility, it remains committed to SOFR as the preferred LIBOR replacement and has asked for public comment on its proposal to calculate and publish compounded averages of SOFR, across various tenors, and the SOFR Index. While this may help allay some concerns, widespread SOFR adoption will rest on how successfully Fed actions address upcoming market stresses. The first test of whether the Fed’s actions are enough to alleviate market stresses could come as soon as yearend, an historically volatile period for the repo market as, similar to quarter end, cash providers once again squirrel away cash to meet year-end regulatory reserve deadlines and Treasury settlements.

Clearing hurdles

SOFR volatility notwithstanding, clear progress was made recently when Fannie Mae and Freddie Mac announced that they will adopt the fallback language and guidelines recommended by the ARRC for newly originated adjustable-rate mortgages (ARMs). These voluntary guidelines offer market participants a consistent, clear approach on the transition process. While a significant step forward towards a world without LIBOR, and without doubt a significant hurdle cleared, the thornier issue of the absence of robust fallback language in legacy contracts remains unaddressed.

As the Resi Symposium panelists made clear, 2020 will be a big year in determining the future for SOFR.