The LIBOR-SOFR Transition Continues Apace

Provided by Structured Finance Association

By Elen Callahan, Jennifer Wolfe and Jen Earyes

Before social distancing entered our collective vocabulary, the financial markets were focused on the transition from the London Interbank Offered Rate (LIBOR) to the Secured Overnight Financing Rate (SOFR (Bloomberg: SFR Comdty)), the rate recommended by the Fed-convened Alternative Reference Rate Committee (ARRC), of which SFA is a member, to replace LIBOR.

The LIBOR panel banks who contribute quotes for calculation of the daily rate, have committed to submitting LIBOR data daily until December 31, 2021, which has become the de facto effective LIBOR cessation date. In response to rising questions around timelines and transition plans in light of COVID-related disruptions, LIBOR’s regulator, the Financial Conduct Authority (FCA), and the ARRC conceded that some transition milestones may be disrupted along the way while re-confirming the target 2021 cessation date and urging market participants to carry on with transition plans with this date in mind.

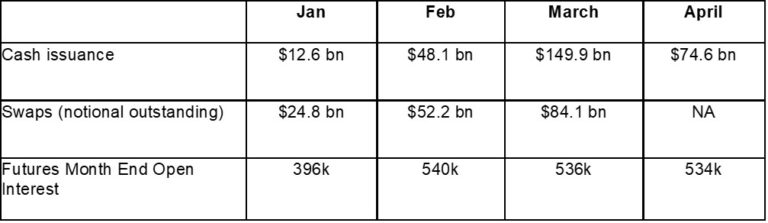

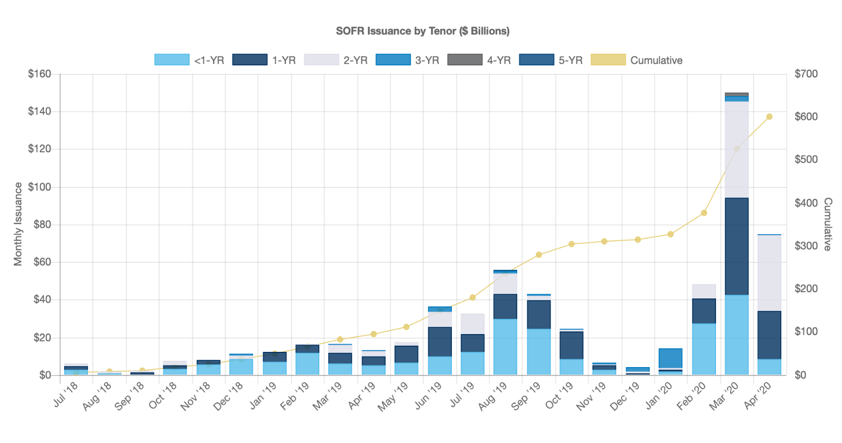

And so, the transition marches forward. So far in 2020, cash issuance totaled $285 billion, with March, arguably the most volatile month in the history of the financial markets, contributing $149.9 billion or 52% to that total. When peaking under the hood, we find more than 90% of March’s volume is attributable to issuance from federal agencies and almost all of March’s bond offerings had maturities of two years or less. Since the market’s start in 2018, cumulative issuance has exceeded $600 billion. The SOFR swaps and futures markets also saw brisk activity during the first four months of the year.

2020 activity has been brisk, so far

Cash issuance since 2018 has cleared $600 billion

Key transition milestones in March included financial accounting relief from the Financial Accounting Standards Board (FASB) and the publication of ARRC’s legislative proposal for modifying LIBOR-based legacy New York contracts to include fallback language where the contract didn’t envision a permanent cession of LIBOR. Fannie Mae and Freddie Mac also made a significant step forward with the announcement that they will not accept adjustable rate mortgages (ARMs) indexed to USD LIBOR beyond 2020. The GSEs also announced that they will adopt ARRC’s recommended fallback language to facilitate a smooth transition away from LIBOR. As scheduled, the New York Fed began publishing 30-, 90-, and 180-day SOFR Averages as well as a SOFR Index. (Details of how the averages are calculated are found here.)

Progress has been equally meaningful in April. The GSEs announced the first ever SOFR-based consumer loan product — the single-family SOFR adjustable rate mortgage, which is indexed to the new Fed-calculated 30-day average SOFR and will replace the LIBOR-based ARM. Whole loan and MBS pricing and deliveries of single-family SOFR ARMs will begin on August 3, 2020.

The LIBOR-SOFR transition is complex and is made more challenging by the sheer size of the $240 trillion USD LIBOR market. Market participants face a mountain of work ahead — from identifying the impact and assessing the exposure of the transition on their organization, to identifying processes, models, and systems that reference or use LIBOR and that will need to be changed, updated, tested and approved.

SFA continues to be guided by the 2021 deadline as we support industry efforts to prepare for and implement such a significant transition. We are monitoring market conditions, guiding the development of best practices and transition timelines, gathering and appropriately taking action on member feedback, all at the same time as our industry balances the economic and business challenges arising from the COVID-19 pandemic. SFA and our members are as committed as before to supporting our industry in the hard work of replacing the world’s most important number.