COVID-19 in the Context of ESG Investing

Provided by Structured Finance Association

By: Elen Callahan

“The explosive increase in world travel by Americans, and in immigration to the United States, is turning us into another melting pot — this time, of microbes that we previously dismissed as just causing exotic diseases in far-off countries.”

Guns, Germs and Steel, Jared Diamond

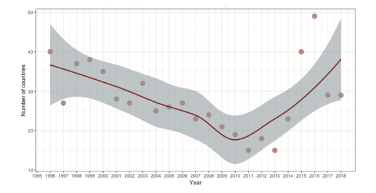

Given the rise of urban living around the world, outbreaks of infectious diseases are inevitable. An increasingly mobile global population, as well as growth of high-density living, outbreaks have risen significantly in the past 30 years (World Economic Forum, January 2019). While not all pandemic in scope, increasingly interdependent economies and complex globalized supply chains have raised global sensitivity to these outbreaks. It is for this reason that some involved in ESG investing have suggested including “business readiness for infectious disease outbreaks” as one of the considerations in the taxonomy used to certify these financial instruments.

History has shown that the negative impact of infectious disease outbreaks on an economy is temporary, but large. Using data from 20th century pandemics, a working paper from the National Bureau of Economic Research estimates the expected loss of income to be $80 billion per year — and may go as high as $570 billion — or 0.7% of global income, when costs include the loss of the value of future lifetime earnings. For context, they note it is “a threat similar in scale to that estimated for climate change in the coming decades.” (Fan, Jamison and Summers, “The Inclusive Cost of Pandemic Influenza Risk”, National Bureau of Economic Research Working Paper No. 22137, 2016). The ability for a business to react quickly to safeguard its employees minimizes disruptions to operations by addressing the health and safety of its employees — a primarysocial component of ESG investing.

The number of countries experiencing significant disease outbreaks, 1995-2018

The COVID-19 is a coronavirus strain that first emerged in the Chinese city of Wuhan, Hubei province, in late December 2019. Since the virus was identified, China has reported over 63,000 confirmed cases and over 1,300 deaths (compared to 28,000 confirmed cases and 565 deaths one week ago). While the virus has already spread to 25 countries, China reported 99% of the confirmed cases and all but one of the deaths.

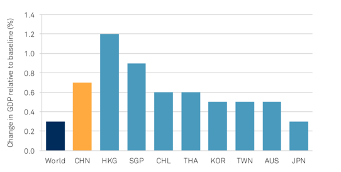

Given China’s expanded role in the global economy, the impact of COVID-19 is expected to be far-reaching. A recent report from S&P Global Ratings estimates that COVID-19 will trim 0.3% from global GDP growth in 2020, with the highest impact in the economies closest and most tightly linked to China. Actual impact, however, may be worse if effective containment is not realized quickly.

Coronavirus Shock: Reduction in 2020 Growth for More Exposed Countries

Source: S&P Global Economics, Oxford Economics https://www.spglobal.com/ratings/en/research-insights/topics/coronavirus-impact

The global travel and tourism industry is expected to feel the most immediate negative impact, as this sector has seen strong support from Chinese tourism. In 2018, over 150 million Chinese tourists left mainland China, according to the United Nations World Tourism Organization. Airlines had expected to expand capacity to and from China, but instead, have had to reduce airline capacity by 80% in the first quarter. The International Civil Aviation Organization estimates that this alone could equate to a potential reduction of $4-5 billion gross operating revenues for airlines worldwide.

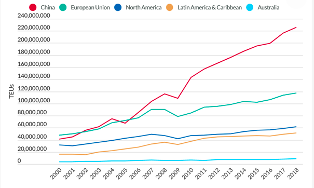

COVID-19 will also have a material impact on the global supply chain. Wuhan — which has been in lockdown since Jan. 23, 2020, and the epicenter of COVID-19 — is also the 13th largest Chinese city in Bloomberg’s supply chain database and, by itself, is a crucial link in the global supply chain for many industries. Wuhan and the surrounding areas of the Hubei province are centers for the iron and steel industry, advanced manufacturing, electronic information, food processing and tobacco, as well as energy and environmental protection. Global auto manufacturers, in particular, will feel this pain as Hubei is the site of 17 auto assembly plants and 272 engine parts producers. The impact on Wuhan will reverberate outside of China as Wuhan’s main export destinations and import sources include the U.S., South Korea, Netherlands, India, Germany, Japan, U.K., Singapore, and Brazil, Taiwan, Australia, Malaysia, and Saudi Arabia.

China’s trade volumes have grown significantly since 2000: Regional Container Port Traffic Growth

https://www.fitchratings.com/site/pr/10110799

The U.S. expected an uptick in exports to China following the signing of the trade agreement between the two countries. As phase one of the trade agreement, China pledged to purchase about $200 billion additional U.S. products over two years. Lawrence Kudlow, White House economic adviser and director of the U.S. National Economic Council, noted that, for the U.S., “the export boom from [the interim trade agreement between U.S. and China] will take longer because of the Chinese virus.”

While it is still too early to fully understand the overall disruptive effect of COVID-19, the ability of infectious diseases such as COVID-19 and SARS to send shock waves through the global economy has become painfully apparent. The more prepared that businesses are to manage future epidemics will have an impact on lives, jobs, and economies. An impactful way to address this is to add business readiness for infectious disease outbreaks as a consideration in ESG taxonomy.