TALF Resurrected

Provided by Structured Finance Association

By Elen Callahan

In response to the economic dislocation brought on by the coronavirus pandemic, the Fed dusted off another powerful crisis-era tool. On March 23, the Fed established the Term Asset-Backed Securities Loan Liquidity Facility (TALF) to support the flow of credit to consumers and businesses. Modeled on the 2008 TALF program, the 2020 TALF will enable the issuance of asset-backed securities (ABS) backed by student loans, auto loans, credit card loans, loans guaranteed by the Small Business Administration (SBA), and certain other asset classes. SFA very much appreciates the sweeping actions taken by the Fed over a very short period of time, and we encourage the Fed to consider providing liquidity to all collateral that is permissible under 13(3) to further support American consumers and businesses during this liquidity crisis.

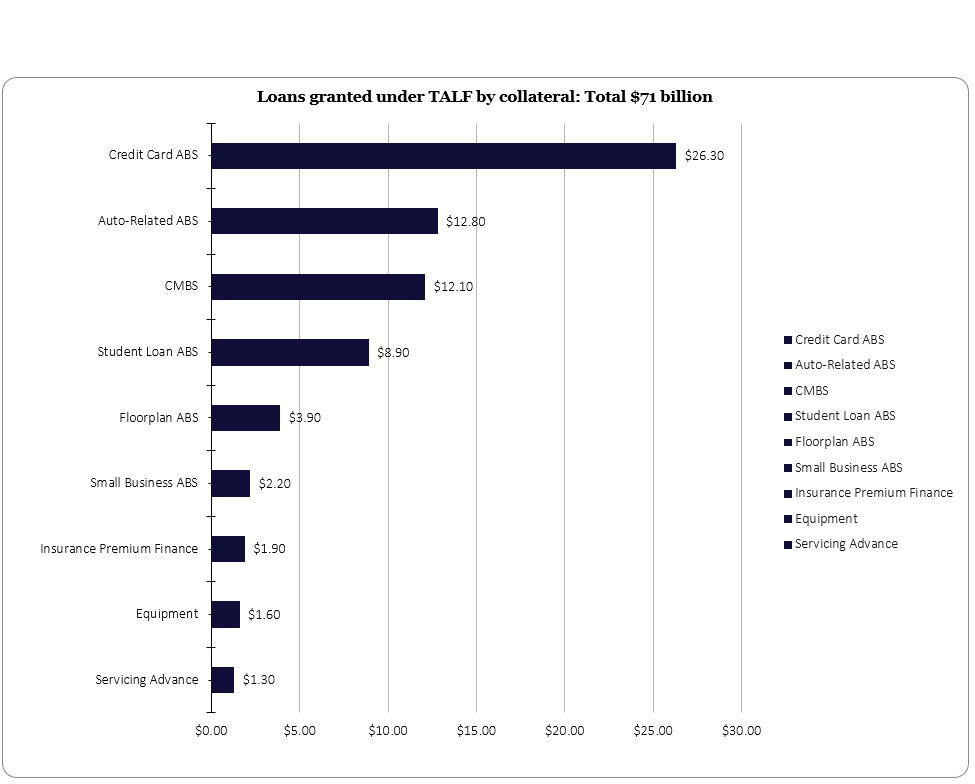

The 2008 TALF quickly and positively impacted the real economy. At a time when millions of Americans needed credit, the Fed’s facility restarted lending through the securitization markets. The 2008 TALF supported the origination of nearly 3 million auto loans, more than 1 million student loans, nearly 900,000 loans to small businesses, 150,000 other business loans, millions of credit card loans. The program did not incur a single dollar of loss and ultimately earned $1.2 billion in interest income for the U.S. taxpayer. Participation came from a wide range of investors, including mutual funds, pension funds, insurance companies, investment funds and hedge funds, and others. We take a closer look at how the 2008 TALF revived lending through the securitization market below.

A look back as a way forward

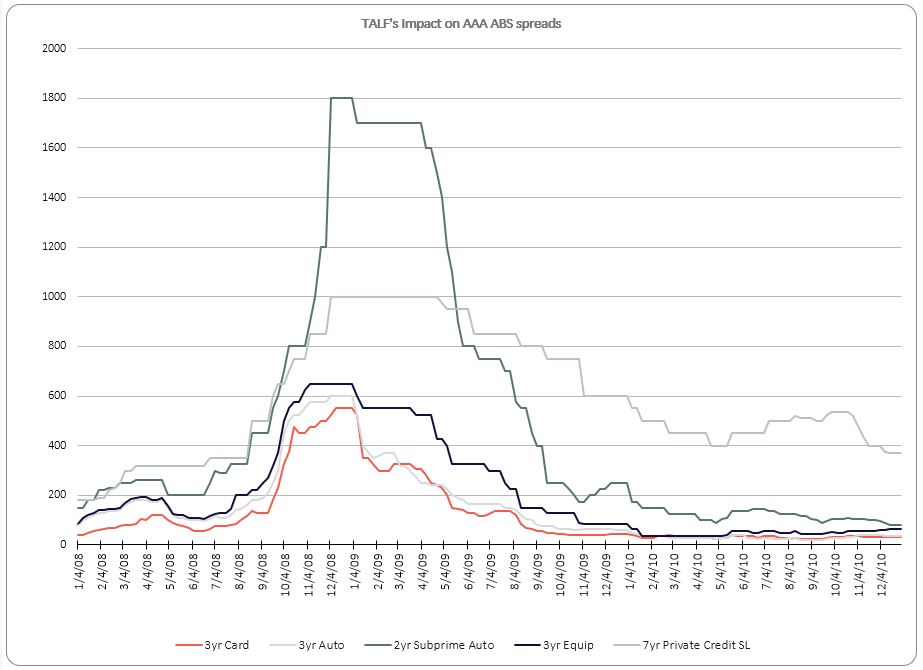

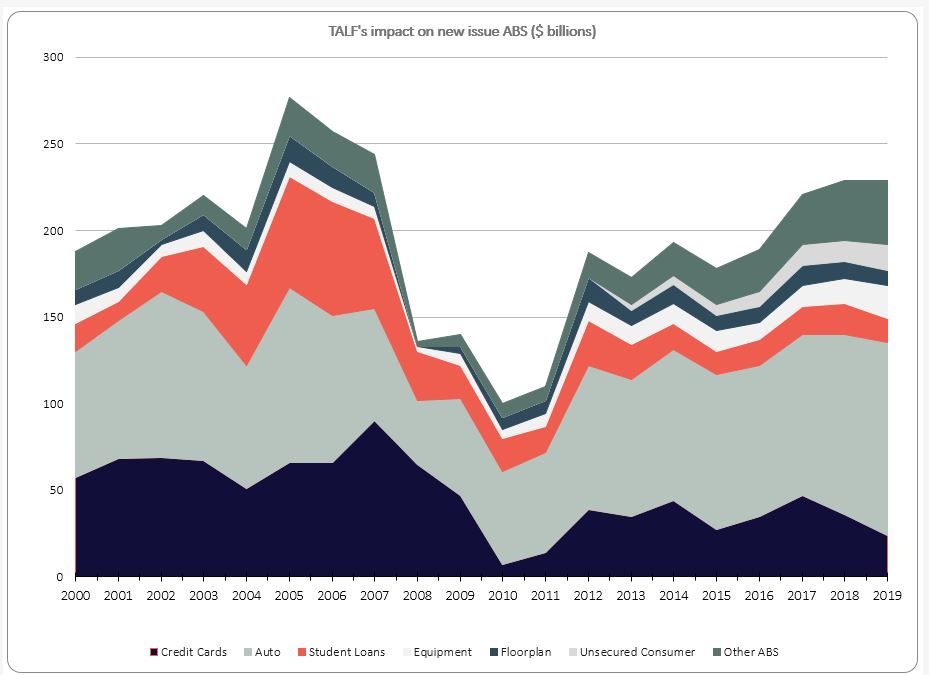

In September of 2008, as a result of a broad and severe recession, new issuance of ABS declined precipitously, and ceased entirely by October of that year. Without the flow of credit between banks, borrowers and capital markets, all types of borrowers – from individuals to businesses – were not able to get the funding they needed to make purchases, cover emergencies and grow their businesses. At the same time, interest rate spreads on AAA-rated tranches of ABS soared to levels well outside the range of historical experience, reflecting the perceptions of higher levels of risk in the ABS market. Since, historically, a substantial share of consumer credit and SBA-guaranteed small business loans has been funded by the ABS markets, disruption in the ABS market significantly limited the availability of credit to households and small businesses and contributed to further weakening of U.S. economic activity. The TALF was designed to increase credit availability and support economic activity by facilitating renewed issuance of consumer and small business ABS at more normal interest rate spreads.

Under 2008 TALF, the Federal Reserve with the support of the U.S. Treasury provided loans to eligible investors for the purpose of investing in triple-A asset backed securities (ABS) backed by auto loans, credit cards, student loans and other eligible debt. The financing was secured by the respective ABS at the time of issuance (and, in the case of CMBS, at or subsequent to issuance). To protect the Federal Reserve and U.S. Treasury, investors had to keep a “first loss” position (called “haircut”). The amount of the haircut was set based upon the asset type, credit quality of the underlying borrower and the term of the TALF financing.

The TALF began operation in March 2009, was expanded twice to include new asset classes, and was closed for new loan extensions on June 30, 2010. In short order, ABS spreads reverted to historical levels as perceived risk fell to more normal levels. The ABS new issue market restarted and lending in the overall economy began anew. On October 29, 2014, the final outstanding TALF loan was repaid in full. Over the life of the program, all TALF loans were repaid in full at or before their respective maturity dates.

Source: JPMorgan, Deutsche Bank, Bloomberg, Federal Reserve Bank

Today’s economic crisis is primarily one of liquidity and not credit quality. Going into 2020, delinquency rates across ABS products were well within acceptable historical bounds as a strong economy and low interest rates helped consumers and businesses meet their financial obligations. However, the economic impacts of the COVID-19 crisis are acute and looming. By supporting the ABS markets, the Fed can inject confidence and the liquidity needed to help our economy recover from this global health crisis. SFA will continue to monitor this fast-evolving situation and work with our members to help individuals and businesses impacted by recent disruptive events.