SFA Continues to Lead ARRC Efforts to Expand on Options for Using SOFR in New ABS, MBS, and CMBS Products

- Written by:

- Alyssa Acevedo, VP of Policy Development

SFA continues to lead the Alternative Reference Rates Committee (ARRC) Securitizations Working Group (SWG) efforts in expanding upon industry built best practice approaches for using the Secured Overnight Financing Rate (SOFR) in new ABS, MBS, and CMBS products to promote industry consistency where appropriate for ABS transactions[1].

As previously covered, the ARRC SWG released a white paper outlining an ARRC best practice approach for using SOFR, with a monthly reset, set in advance of the accrual period similar to the most-used approach for one-month LIBOR today. The latest release by the ARRC SWG is an Addendum to the initial white paper and describes how an in arrears methodology referencing SOFR could be used as an all-in index in new U.S. issuance of ABS and establishing standard conventions for such a methodology.

As a refresher, the ARRC is a group of private-market participants convened to help ensure a successful transition from USD LIBOR to SOFR, described to be a more robust reference rate and the ARRC’s recommended alternative. SFA co-chairs the ARRC’s SWG which is tasked with developing recommendations to help the ARRC facilitate discussion and make informed decisions. Most recently, the ARRC asked the SWG to identify the key considerations relevant to developing new issuance of securitized products based on SOFR.

SWG members include representatives of issuers, underwriters, arrangers, trustees, servicers, calculation agents, note administrators, trust administrators, and investors. These members participated in a months-long process sharing insights and perspectives on current market operations, investor preferences, and market trends in reaching a consensus view on the options for the use of SOFR in ABS, MBS, and CMBS products.

The SWG’s decision to focus on an in advance option for market participants’ consideration first was driven primarily by aspects of the underlying collateral as well as operational complexities, identifying that traditional systems and processes may not be able to easily accommodate an in arrears approach. It also follows a similar approach to the use of LIBOR in most securitization transactions today. Observing that other cash products as well as foreign issuance of ABS have identified conventions for using in arrears, the SWG next engaged in further discussion to determine how SOFR in arrears could be incorporated in U.S. issuance of ABS where parties find it suitable.

The explanations and industry participant considerations detailed in the Addendum cover various attributes related to an in arrears methodology, adjustments for in arrears framework (lockout, payment delay and lookback), and deliberation over the length of time for the lookback period.

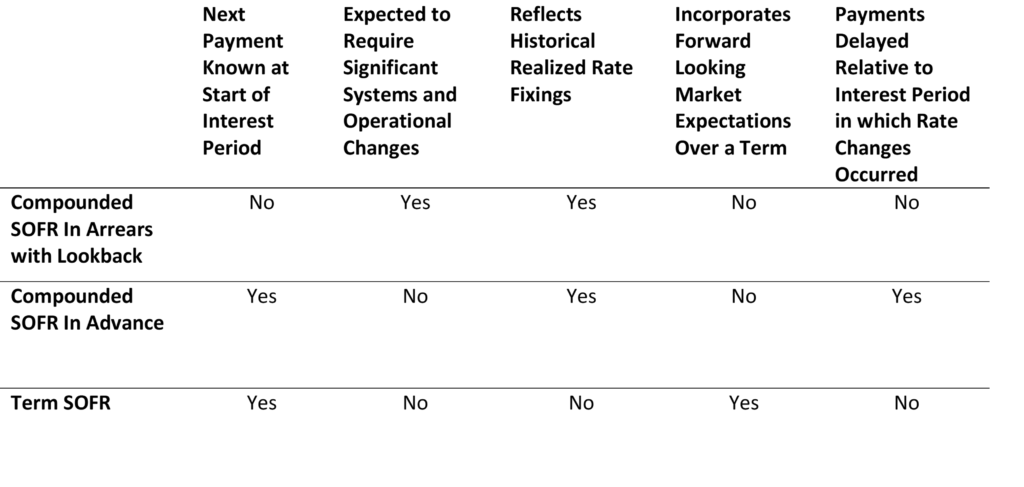

The SWG acknowledged that an in arrears methodology may be preferred by some market participants in certain transactions depending on the asset class and structural features of the transaction. SWG members also compared various details of compounded SOFR in arrears with a lookback, compounded SFOR in advance, and Term SOFR:

When considering adjustments for an in arrears framework, SWG members agreed that a lockout or payment delay adjustment would most often not be workable when using an in arrears framework in securitization transactions. However, a lookback adjustment could be a needed feature. When considering a lookback period, it was found that issuers will need to make their own risk assessments on whether they are comfortable and under what time period when taking into consideration required operational review, audits, and quality control.

The deliberation over the length of time of the lookback period was the most significant of all attributes discussed with the SWG. A longer lookback period provides additional time for issuers which is valuable from an operational standpoint and when reconciling and processing both asset and liability cash flows. Whereas Investors prefer the shortest lookback period possible to fully achieve the benefits of the in arrears approach.

SFA strongly encourages market consistency within a limited number of select interest rate calculation conventions based upon a survey of our members that showed the vast majority prefer two or fewer conventions within the market to ease operational burdens and investment analysis. Further, SFA supports the use of the in advance and in arrears approaches published by the ARRC SWG where suitable for contractual parties.

Visit SFA’s LIBOR Transition page for further information and to stay up to date on all the latest happenings in this space.

[1] The white paper and addendum refer to ABS transactions as representing collectively ABS, MBS, and CMBS (including Single-Asset, Single-Borrower transactions, and Commercial Real Estate CLOs products) and does not address Corporate CLO products.

Latest Blogs

SFVegas 2024 AttendeeHub Login Instructions

March 2024

Securitization Benefits Americans by Reducing Risk and Interest Rates

December 2023

Consumers Defy Economists’ Optimism

November 2023

Recent Trends in U.S. Home Prices and Mortgage Interest Rates

November 2023

Stop the Government Debt and Spending Spiral

November 2023