Fed’s Extraordinary Measures During These Extraordinary Times

By: Elen Callahan

Extraordinary times call for extraordinary measures. And the Fed continues to respond appropriately. On April 9, the Federal Reserve once again drew on its full range of authorities to expand and establish lending facilities to provide up to $2.3 trillion in loans to stabilize households, communities and businesses of all sizes during the pandemic crisis and to “ensure that the eventual recovery is as vigorous as possible”. The announcement coincided with a jobless claims report that revealed another 6.6 million Americans had lost their jobs, bringing total unemployment claims close to a staggering 17 million in just three weeks, as measures needed to contain the outbreak continued to take their toll on the U.S. economy. Below we take a closer look at the programs that partner with the securitization industry to help bring much needed liquidity back to the American economy. A summary of these programs may be found on our website.

2020 TALF

The securitization markets were pleased the Fed’s April 9 announcement included some additional program details for the 2020 Term Asset-Backed Securities Loan Facility (TALF). (SFA compares the 2008 and 2020 programs here.) The facility, which was announced on March 23, will make available up to $100 billion in non-recourse loans secured by eligible ABS collateral. Maximum term for the loans is 3 years. An updated term sheet accompanied the April 9 announcement, which clarified the list of eligible collateral that may be pledged to the program, and expanded the scope to include static CLOs and legacy CMBS. The interest rate payable to the Fed and the haircut percentage (the borrower’s equity stake in the pledged collateral) are tied to the average life of the bonds and the underlying collateral type. Pricing information was released for a subset of the eligible collateral types. The interest payable to the Fed is floating rate with the benchmark based upon either the fed funds overnight index swap (OIS) rate or the 30-day average secured overnight financing rate (SOFR), the Fed’s recommended replacement rate for LIBOR, depending upon the collateral type.

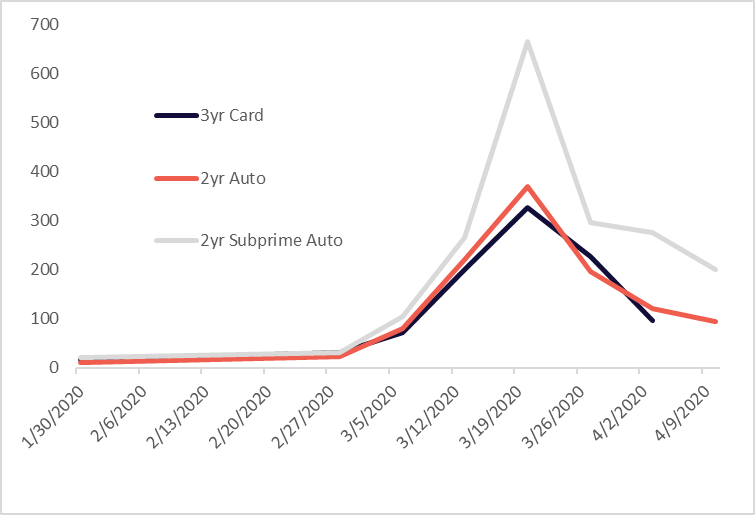

The re-establishment of TALF, on March 23, came as financing conditions in the consumer credit markets had worsened. In March, consumer ABS spreads, which reflect both liquidity and perceived credit risk, widened sharply, with some on-the-run asset classes, known to be the most liquid of ABS asset classes, recording spread levels that were 900% wider than historical averages. Liquidity in the secondary markets had deteriorated and new issuance activity became scant. Prior to the coronavirus outbreak, lenders in consumer credit markets were focused on disciplined growth as balances had been rising through the end of 2019. As more borrowers were affected by the outbreak and containment measures became widespread, lenders retrenched and turned their focus on helping their customers handle COVID-19 related hardships through consumer relief programs and in many cases extending credit to income-strapped customers, even as the specter of a widespread recession moved from theory to reality.

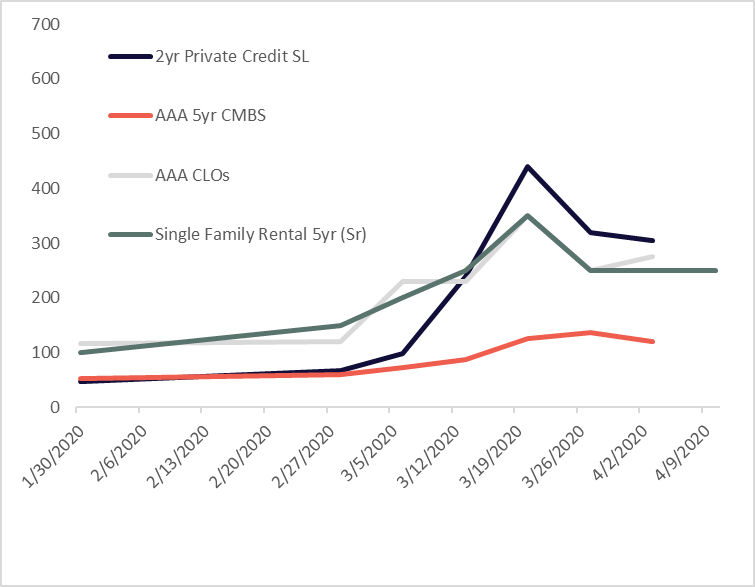

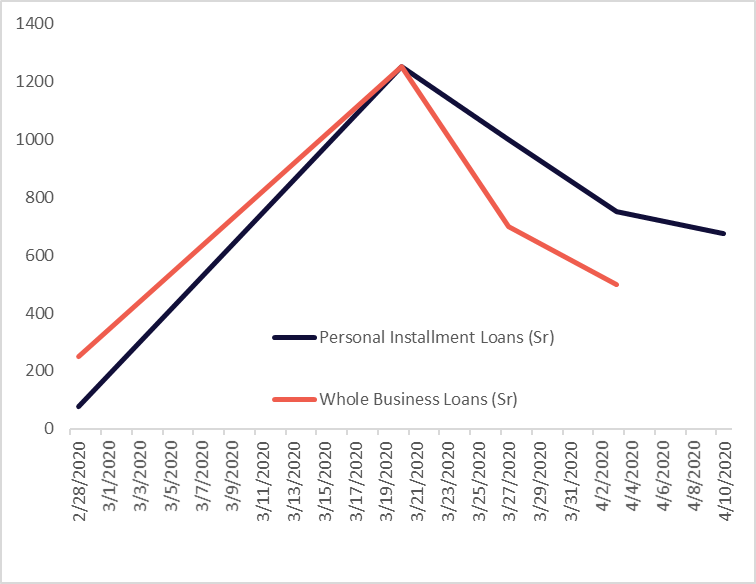

The announcement of 2020 TALF, and the knowledge that a funding backstop exists for certain new issue ABS securities, brought the first signs of stability back to the secondary market of major ABS asset classes. Following the March 23 announcement, collateral that was clearly designated as TALF-eligible experienced meaningful spread tightening in the secondary market, some of it by as much as 50%. We saw the same phenomenon again when, following the April 9 expansion, the secondary market spreads of newly-distinguished-as-eligible triple-A CLOs and CMBS tightened on the day by 30-50 bp. Meanwhile, spreads on asset classes that did not make the TALF cut, such as ABS backed by personal installment loans and private label mortgages, languished with significantly less to no tightening from the current historically wide levels (Spread details below. Graphs show triple-A level unless otherwise noted.). It remains to be seen whether these asset classes will benefit meaningfully from a “rising tide” effect when TALF officially launches or whether these asset classes will fall victim to lack of liquidity, forcing lenders to cut off credit to borrowers at a time when they need it most.

In last week’s announcements the CLO market and the corporate sector saw strong support from the Fed’s revised and new emergency programs. In addition to the TALF inclusion, CLOs are also now eligible for the Primary Dealer Credit Facility, a short term loan program available to primary dealers of the New York Fed. CLOs will also benefit, albeit indirectly, from any improved liquidity in the non-investment grade corporate bond and loan markets, sectors that had not been addressed by any Fed program until the recent expansion of the PMCCF, the SMCCF, and the just announced MSLF and MSELF (all discussed in the next section). CLOs are primarily backed by broadly syndicated loans to non-investment grade corporate borrowers, which are eligible for the PMCCF programs. A smaller portion of CLOs is backed by middle market loans made to mid-size corporate borrowers many of whom are expected to be eligible for the MSLF and MSELF programs. We also discuss these programs below.

PMCCF, SMCCF, MSLF, MSELF, and PPP to address business borrowers of all sizes

Diverging from the 2008 playbook the Fed has created two facilities to support large non-financial corporate borrowers. The Primary Market Corporate Credit Facility (PMCCF) was set up to purchase corporate bonds and participate in broadly syndicated loans from the new issue market. The Secondary Market Corporate Credit Facility (SMCCF) will purchase corporate bonds in the secondary markets. Both facilities, with a combined capacity of $750 billion will provide 4-year loans on a recourse basis. We provide details here.

Announced on March 23, the programs saw a meaningful expansion on April 9 when both programs were opened to include recent “fallen angels” or corporate borrowers who were investment grade on March 22 but have since been downgraded to at least BB-/Ba3 at the time of the facility purchase. This is expansion comes as a record $90 billion of investment grade debt has fallen to non-investment grade status since March 22. The spread on the Bloomberg Barclay high-yield corporate bond index, which reached period wides on March 23, have responded favorably, tightening 225 bps since the programs were announced.

While details have yet to be released, the Main Street Lending Facility (MSLF) and the Main Street Expanded Lending Facility (MSELF) have been established to provide financing to lenders that make direct loans to U.S. business with up to 10,000 employees or up to $2.5 billion in 2019 annual revenues. Treasury Secretary Steven Mnuchin estimates that there are 40,000 mid-sized companies that fall in this category. These businesses are typically too small to access the capital markets and thus receive funding directly from lenders. Unlike the PMCCF and SMCCF, the Main Street facilities will purchase 95% participation in loans extended to middle market borrowers; 5% will be required to be retained by the lender. Eligible borrowers may be rated investment grade or non-investment grade and must attest financing is required due to the exigent circumstances presented by the coronavirus disease 2019 (“COVID-19”) pandemic. Given the unprecedented way in which the economic shutdown is touching virtually all sectors of the economy, it is very likely that MSLF will be a critical tool in getting funds in the hands of companies, especially those that fall outside of the Paycheck Protection Program (PPP) which provides forgivable loans to small businesses. Funds must be used to maintain its payroll and retain employees. The facilities, with a combined size of $600 billion, will provide loans on a recourse basis.

The Structured Finance Association (SFA) applauds the Federal Reserve for taking these additional steps to support the economy, the scale and speed of which has been unprecedented. SFA will continue to monitor market reaction, communicate these clearly to decision makers in Washington, and will continue to support our members as we collaborate with government to address today’s challenges.