GSE’s Face Amendments to Preferred Stock Purchase Agreements: How the New Regulatory Caps Will Impact Homeowners

GSE’s Face Amendments to Preferred Stock Purchase Agreements: How the New Regulatory Caps Will Impact Homeowners

Written by:

- Jeff Gudiel, Analyst, Policy Development, Structured Finance Association

On January 14, 2021, The Federal Housing Finance Agency (FHFA) and the U.S. Department of the Treasury announced amendments to the Preferred Stock Purchase Agreements (PSPAs). The PSPAs directs the financial relationship between the Treasury, as senior preferred shareholder and capital provider, and Fannie Mae and Freddie Mac (the GSEs). Under the PSPAs, which were entered into the day after the GSEs entered conservatorship, the Treasury pledged capital support to the GSEs for the purpose of “provid[ing] confidence to financial markets and ensur[ing] the continued flow of mortgage credit.”

According to a Treasury press release, January’s amendments move the GSEs “toward capitalization levels consistent with their size, risk, and importance to the U.S. economy, and to codify several existing FHFA conservatorship practices, including providing small lender protections and limiting future increases in certain higher risk lending practices.” Below we take a closer look at the agreements’ attempt to constrain one of these “higher risk lending practices,” as defined by the PSPA.

The amended agreement outlines modifications to raising capital, business operations and future payment to the Treasury. This includes a new restriction on the acquisition of “higher-risk” single-family mortgages to a maximum of 6% of purchase money mortgages and a maximum of 3% of refinance mortgages over the trailing 52-week period.

Under the new PSPA agreements, a loan is considered high-risk if two of following three apply:

- It is more than 90% of the home’s value or loan-to-value (LTV).

- The borrower’s debt-to-income (DTI) is more than 45%.

- The borrower has a FICO score below 680.

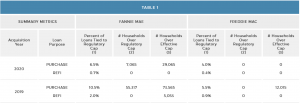

In a blog published by Falcon Capital Advisors, their Data Analytics group estimated that, for the period between 2019-2020, approximately 60,000 households would have been denied GSE financing under the regulatory cap. However, in order to effectively stay well within the caps, Falcon Capital Advisors suggest the GSEs would have to implement “Effective Caps” that are even lower than the 6% (purchase money) and 3% (refinance). Falcon estimates that these effective caps to be at 4.5% and 1.5% for purchase and refinance mortgages, respectively. Given that assumption, Falcon anticipates that over a two-year period, these lower effective caps would deny GSE financing to as many as 40,000 additional households (see Table 1). Falcon Capital anticipates, under the current amendments, borrowers whose loans are >45 DTI and >90 OLTV will be the most impacted.

Source: eMBS and 1010Data. As of February 18, 2021. Falcon Capital Advisors’ Data Analytics Team.

Note: Estimates reflect presumed “effective caps” lower than the actual regulatory caps.

The long-term effects of the amendments on the PSPAs are still unclear, particularly what it means for borrowers excluded from GSE financing under the caps. If policymakers take steps to funnel these marginally riskier excluded loans towards sources of private capital (i.e., PLS securitization of bank portfolio lending but likely at a higher interest rate), it may achieve the stated goal of removing risk from taxpayers. However, if such borrowers simply shift to FHA, taxpayers would still be on the hook.

Armando Falcon, CEO of Falcon Capital Advisors, concludes that, “The substantial decline in this type of affordable lending since 2019 is clearly the result of FHFA regulatory policy that is now publicly memorialized in the recent PSPA amendment. It remains to be seen if the Biden Administration, and possibly new leadership at the FHFA, will reverse the FHFA policy.”

For further questions on SFA’s engagement as it relates to mortgages and GSEs, please contact Director of MBS Policy, Dallin Merrill.

Latest Blogs

SFVegas 2024 AttendeeHub Login Instructions

March 2024

Securitization Benefits Americans by Reducing Risk and Interest Rates

December 2023

Consumers Defy Economists’ Optimism

November 2023

Recent Trends in U.S. Home Prices and Mortgage Interest Rates

November 2023

Stop the Government Debt and Spending Spiral

November 2023